Albertsons 2016 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is listed on the New York Stock Exchange under the symbol SVU. As of April 22, 2016, there

were 17,081 stockholders of record.

Common Stock Price

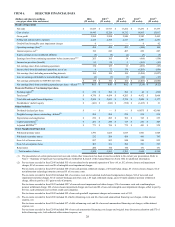

Common Stock Price Range

2016 2015

Fiscal High Low High Low

First Quarter $ 12.00 $ 8.22 $ 8.12 $ 6.05

Second Quarter 9.37 7.26 9.78 7.57

Third Quarter 8.27 6.15 9.76 7.83

Fourth Quarter 7.17 3.94 10.49 8.72

Year $ 12.00 $ 3.94 $ 10.49 $ 6.05

The Company did not declare any dividends in fiscal 2015 or fiscal 2016 and the Company has no current intent to pay

dividends. The Company is limited in the aggregate amount of dividends that it may pay under the terms of the Company's

$1,500 term loan facility (the “Secured Term Loan Facility”) and the Company’s $1,000 asset-based revolving ABL credit

facility (the “Revolving ABL Credit Facility”) and would need to meet certain conditions under these credit facilities before

paying a dividend, as described in Note 7—Long-Term Debt in Part II, Item 8 of this Annual Report on Form 10-K. The

payment of future dividends is subject to the discretion of the Company’s Board of Directors and the requirements of Delaware

law, and will depend on a variety of factors that the Company’s Board of Directors may deem relevant.

Company Purchases of Equity Securities

The following table sets forth the Company’s purchases of equity securities for the periods indicated:

(in millions, except shares and per share

amounts)

Period (1)

Total Number

of Shares

Purchased (2)

Average

Price Paid

Per Share

Total Number of

Shares

Purchased as

Part of Publicly

Announced Plans

or Programs

Approximate

Dollar Value of

Shares that May

Yet be Purchased

Under the Plans

or Programs

First four weeks

December 6, 2015 to January 2, 2016 6,499 $ 7.01 — $ —

Second four weeks

January 3, 2016 to January 30, 2016 762 $ 4.32 — $ —

Third four weeks

January 31, 2016 to February 27, 2016 — $ — — $ —

Totals 7,261 $ 6.73 — $ —

(1) The reported periods conform to the Company’s fiscal calendar composed of thirteen 28-day periods.

(2) These amounts represent the deemed surrender by participants in the Company’s compensatory stock plans of 7,261 shares of previously

issued common stock. These amounts are in payment of the purchase price for shares acquired pursuant to the exercise of stock options

and satisfaction of tax obligations arising from such exercises, as well as from the vesting of restricted stock awards granted under such

plans.

Stock Performance Graph

The following graph compares the yearly change in the Company’s cumulative shareholder return on its common stock for the

period from the end of fiscal 2011 to the end of fiscal 2016 to that of the Standard & Poor’s (“S&P”) MidCap 400, a group of

peer companies in the retail grocery and distribution industries, which are the same peer companies as used in fiscal 2015 other

than Spartan Stores Inc. is now SpartanNash Corporation. The stock price performance shown below is not necessarily

indicative of future performance.