Albertsons 2016 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

Under the replacement cost method applied on a LIFO basis, the most recent purchase cost is used to calculate the current cost

of inventory before application of any LIFO reserve. The replacement cost approach results in inventories being valued at the

lower of cost or market because of the high inventory turnover and the resulting low inventory days supply on hand combined

with infrequent vendor price changes for these items of inventory.

The replacement cost approach under the FIFO method is predominantly utilized in determining the value of high turnover

perishable items, including produce, deli, bakery, meat and floral.

As of February 27, 2016 and February 28, 2015, approximately 26 percent and 26 percent, respectively, of the Company’s

inventories were valued using the cost, weighted average cost and RIM methods under the FIFO method of inventory

accounting. The remaining 17 percent and 19 percent of the Company’s inventories as of February 27, 2016 and February 28,

2015, respectively, were valued using the replacement cost approach under the FIFO method of inventory accounting. The

replacement cost approach applied under the FIFO method results in inventories recorded at the lower of cost or market

because of the very high inventory turnover and the resulting low inventory days supply for these items of inventory.

During fiscal 2016 and 2014, inventory quantities in certain LIFO layers were reduced. These reductions resulted in a

liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared with the cost of fiscal 2016

and 2014 purchases. As a result, Cost of sales decreased by $1 and $14 in fiscal 2016 and 2014, respectively. If the FIFO

method had been used to determine cost of inventories for which the LIFO method is used, the Company’s inventories would

have been higher by approximately $215 and $211 as of February 27, 2016 and February 28, 2015, respectively.

The Company evaluates inventory shortages throughout each fiscal year based on actual physical counts in its stores and

distribution facilities. Allowances for inventory shortages are recorded based on the results of these counts to provide for

estimated shortages as of the end of each fiscal year.

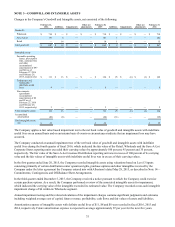

Property, Plant and Equipment, Net

Property, plant and equipment are carried at cost. Depreciation is based on the estimated useful lives of the assets using the

straight-line method. Estimated useful lives generally are ten to 40 years for buildings and major improvements, three to ten

years for equipment, and the shorter of the term of the lease or expected life for leasehold improvements and capitalized lease

assets. Interest on property under construction of $1, $1 and $1 was capitalized in fiscal 2016, 2015 and 2014, respectfully.

Business Dispositions

The Company reviews the presentation of planned business dispositions in the Consolidated Financial Statements based on the

available information and events that have occurred.

The review consists of evaluating whether the business meets the definition as a component for which the operations and cash

flows are clearly distinguishable from the other components of the business, and if so, whether it is anticipated that after the

disposal the cash flows of the component would be eliminated from continuing operations and whether the disposition

represents a strategic transaction that has a major effect on operations and financial results. In addition, the Company evaluates

whether the business has met the criteria as a business held for sale. In order for a planned disposition to be classified as a

business held for sale, the established criteria must be met as of the reporting date, including an active program to market the

business and the expected disposition of the business within one year.

Planned business dispositions are presented as discontinued operations when all the criteria described above are met.

Operations of the business components meeting the discontinued operations requirements are presented within Income from

discontinued operations, net of tax in the Consolidated Statements of Operations, and assets and liabilities of the business

component planned to be disposed of are presented as separate lines within the Consolidated Balance Sheets. See Note 16—

Discontinued Operations for additional information.

Businesses held for sale are reviewed for recoverability of the carrying value of the business upon meeting the classification

requirements. Evaluating the recoverability of the assets of a business classified as held for sale follows a defined order in

which property and intangible assets subject to amortization are considered only after the recoverability of goodwill, indefinite

lived intangible assets and other assets are assessed. After the valuation process is completed, the held for sale business is

reported at the lower of its carrying value or fair value less cost to sell, and no additional depreciation or amortization expense

is recognized. The carrying value of a held for sale business includes the portion of the accumulated other comprehensive loss

associated with pension and postretirement benefit obligations of the operations of the business.

There are inherent judgments and estimates used in determining impairment charges. The sale of a business can result in the

recognition of a gain or loss that differs from that anticipated prior to closing.