Albertsons 2016 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

recognizes gains or losses over a three year period, the future value of assets will be impacted as previously deferred gains or

losses are recognized.

For those retirees whose health plans provide for variable employer contributions, the assumed healthcare cost trend rate used

in measuring the accumulated postretirement benefit obligation before age 65 was 7.00 percent as of February 27, 2016. The

assumed healthcare cost trend rate for retirees before age 65 will decrease by 0.25 percent for each year through fiscal 2026,

until it reaches the ultimate trend rate of 4.50 percent. For those retirees whose health plans provide for variable employer

contributions, the assumed healthcare cost trend rate used in measuring the accumulated postretirement benefit obligation after

age 65 was 7.80 percent as of February 27, 2016. The assumed healthcare cost trend rate for retirees after age 65 will decrease

through fiscal 2026, until it reaches the ultimate trend rate of 4.50 percent. For those retirees whose health plans provide for a

fixed employer contribution rate, a healthcare cost trend is not applicable. The healthcare cost trend rate assumption would have

the following impact on the amounts reported: a 100 basis point increase in the trend rate would impact the Company’s service

and interest cost by less than $1 for fiscal 2016; a 100 basis point decrease in the trend rate would decrease the Company’s

accumulated postretirement benefit obligation as of the end of fiscal 2016 by approximately $3; and a 100 basis point increase

would increase the Company’s accumulated postretirement benefit obligation by approximately $3.

Pension Plan Assets

Plan assets are held in a master trust and invested in separately managed accounts and other commingled investment vehicles

holding domestic and international equity securities, domestic fixed income securities and other investment classes. The

Company employs a total return approach whereby a diversified mix of asset class investments is used to maximize the long-

term return of plan assets for an acceptable level of risk. Alternative investments are also used to enhance risk-adjusted long-

term returns while improving portfolio diversification. Risk is managed through diversification across asset classes, multiple

investment manager portfolios and both general and portfolio-specific investment guidelines. Risk tolerance is established

through careful consideration of the plan liabilities, plan funded status and the Company’s financial condition. This asset

allocation policy mix is reviewed annually and actual versus target allocations are monitored regularly and rebalanced on an as-

needed basis. Plan assets are invested using a combination of active and passive investment strategies. Passive, or “indexed”

strategies, attempt to mimic rather than exceed the investment performance of a market benchmark. The plan’s active

investment strategies employ multiple investment management firms. Managers within each asset class cover a range of

investment styles and approaches and are combined in a way that controls for capitalization, and style biases (equities) and

interest rate exposures (fixed income) versus benchmark indices. Monitoring activities to evaluate performance against targets

and measure investment risk take place on an ongoing basis through annual liability measurements, periodic asset/liability

studies and quarterly investment portfolio reviews.

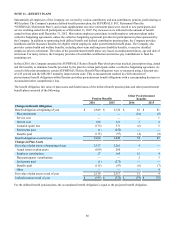

The asset allocation targets and the actual allocation of pension plan assets are as follows:

Asset Category Target 2016 2015

Domestic equity 22.2% 22.4% 24.8%

International equity 11.1% 11.1% 11.3%

Private equity 6.6% 6.6% 6.2%

Fixed income 47.5% 47.3% 48.1%

Real estate 12.6% 12.6% 9.6%

Total 100.0% 100.0% 100.0%

The following is a description of the valuation methodologies used for investments measured at fair value:

Common stock—Valued at the closing price reported in the active market in which the individual securities are traded.

Common collective trusts—Valued at net asset value (“NAV”), which is based on the fair value of the underlying securities

owned by the fund divided by the number of shares outstanding. The NAV unit price is quoted on a private market that is

not active. However, the NAV is based on the fair value of the underlying securities within the fund, which are traded on an

active market, and valued at the closing price reported on the active market on which those individual securities are traded.

Corporate bonds—Valued based on yields currently available on comparable securities of issuers with similar credit

ratings. When quoted prices are not available for identical or similar bonds, the fair value is based upon an industry

valuation model, which maximizes observable inputs.

Government securities—Certain government securities are valued at the closing price reported in the active market in

which the security is traded. Other government securities are valued based on yields currently available on comparable

securities of issuers with similar credit ratings.