Albertsons 2016 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

• Continued development and sales penetration of the Company's private label product offerings, including organic products,

by providing innovative products in multiple channels across Retail and Wholesale

• Increasing capital spending on new stores, relocations and targeted store remodels

Corporate:

• Continued management of the Company's overhead cost structure to enable investments in lower prices to customers

• Providing high-quality administrative support services by enhancing the Company's service offerings and information

technology systems

• Continued exploration of a potential separation of the Save-A-Lot business

On July 28, 2015, the Company announced that it is exploring a separation of its Save-A-Lot segment, and that as part of

that process it had begun preparations to allow for a possible spin-off of Save-A-Lot into a stand-alone, publicly traded

company. On January 7, 2016, Save-A-Lot, Inc. filed a Form 10 with the SEC as part of its potential separation from the

Company. No specific timetable for a separation has been set and there can be no assurance that a separation will be

completed or that any other change in the Company’s overall structure or business model will occur.

Building a quality Save-A-Lot management team, including Eric Claus as Chief Executive Officer, who brings over

thirty years of experience in the retail industry where he has gained deep experience in both hard discount and grocery

retail in both the United States and Canada.

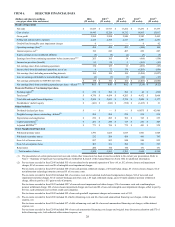

Fiscal 2016 Highlights

Improvements to the Company's financial condition include:

• Redeemed the remaining $278 of the Company's 8.00% Senior Notes due May 2016 with borrowings under the Revolving

ABL Credit Facility and internally generated funds, which reduced borrowings, extended debt maturities and lowered the

prevailing interest rate on borrowings

• Amended, repriced and extended the Revolving ABL Credit Facility to reduce the rates on borrowings and letters of credit

and the facility fees, as well as extend its maturity by approximately sixteen months to February 3, 2021. This amendment

also provides flexibility for a spin-off of Save-A-Lot

• Funded $25 of discretionary pension contributions

Financial highlights for fiscal 2016 compared to fiscal 2015 include:

• Net sales decreased $388, which included a decrease of $313 from the additional week in fiscal 2015. Excluding the

additional week of sales in fiscal 2015, Net sales decreased by $75 primarily related to lower sales from closed stores, lost

customers and lower identical store sales, offset in part by new store sales, sales to new customers and higher transition

service agreement fees.

Wholesale Net sales were negatively impacted in fiscal 2016 by the loss of distribution to certain Albertson's stores in

the Southeast along with softer year-over-year sales to existing customers.

Save-A-Lot opened 80 new stores, comprised of 42 new corporate stores and 38 new licensee stores, and closed 54

Save-A-Lot stores, comprised of 36 licensee stores and 18 corporate stores. In addition, eight Save-A-Lot licensee

stores were converted to corporate stores. The Company plans to open approximately 75 new Save-A-Lot stores in

fiscal 2017.

Within Retail, management believes pricing and promotional adjustments in fiscal 2016 to partially mitigate

compressed pharmacy margins due to lower managed care reimbursement rates negatively impacted Retail traffic

levels and Net sales in fiscal 2016. This pharmacy margin compression is expected to continue to impact Retail's

results of operations.

The Company's private brands product assortment and offerings resonated with customers in fiscal 2016, resulting in

an improvement to the Company's private brands penetration rate of approximately 100 basis points within Save-A-

Lot and Retail.

• Gross profit decreased $4, which included a decrease of $49 from the additional week of sales in fiscal 2015. Excluding

the additional week of sales in fiscal 2015, Gross profit increased $45 primarily due to higher base margins, lower

logistics costs, higher transition service agreement fees and higher trucking back-haul income, offset in part by higher

employee-related costs, inventory shrink and occupancy costs.

• Operating earnings increased $30 driven by lower net charges and costs in fiscal 2016 compared to last year. When

adjusted for these items (refer to the fiscal 2016 Operating Earnings section below for descriptions and a reconciliation of

these charges and costs) and excluding an approximate benefit of $17 from an additional week of sales in fiscal 2015,

Operating earnings increased $13 primarily due to higher gross profit base margins, lower logistics costs, higher transition

service agreement fees, lower depreciation and amortization expense and higher trucking back-haul income, offset in part

by higher occupancy, inventory shrink and other administrative costs, and higher payment processing, bad debt,

contracted services and pension expenses.