Albertsons 2016 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

NOTE 9—INCOME TAXES

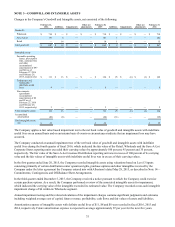

Income Tax Provision

The provision (benefit) for income taxes consisted of the following:

2016 2015 2014

Current

Federal $ 77 $ 35 $ 30

State 10 7 5

Total current 87 42 35

Deferred (2) 16 (30)

Total income tax provision $ 85 $ 58 $ 5

The difference between the actual tax provision and the tax provision computed by applying the statutory federal income tax

rate to Earnings from continuing operations before income taxes is attributable to the following:

2016 2015 2014

Federal taxes based on statutory rate $ 92 $ 62 $ 4

State income taxes, net of federal benefit 6 12 —

Tax contingency (6)(1)(1)

Change in valuation allowance 4 — (1)

Pension (4)(8) —

Other (7)(7) 3

Total income tax provision $ 85 $ 58 $ 5

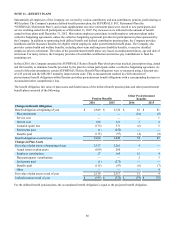

Deferred Income Taxes

Deferred income taxes reflect the net tax effects of temporary differences between the basis in assets and liabilities for financial

reporting and income tax purposes. The Company’s deferred tax assets and liabilities consisted of the following:

2016 2015

Deferred tax assets:

Compensation and benefits $ 235 $ 234

Self-insurance 27 25

Property, plant and equipment and capitalized lease assets 47 72

Loss on sale of discontinued operations 1,388 1,387

Net operating loss carryforwards 15 19

Other 83 69

Gross deferred tax assets 1,795 1,806

Valuation allowance (1,408)(1,404)

Total deferred tax assets 387 402

Deferred tax liabilities:

Property, plant and equipment and capitalized lease assets (108)(88)

Inventories (6)(14)

Intangible assets (24)(27)

Other (21)(23)

Total deferred tax liabilities (159)(152)

Net deferred tax assets $ 228 $ 250

During the fourth quarter of fiscal 2016, the Company early adopted ASU 2015-17, which requires that all deferred taxes be

presented as non-current on the Consolidated Balance Sheet. Refer to Note 1—Summary of Significant Accounting Policies,

for further information on this balance sheet reclassification.