Albertsons 2016 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.80

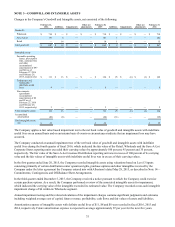

included in Cash and cash equivalents and all of the Company’s pharmacy scripts included in Intangible assets, net, in the

Consolidated Balance Sheets.

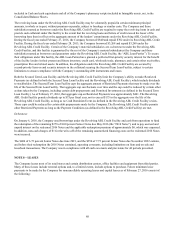

The revolving loans under the Revolving ABL Credit Facility may be voluntarily prepaid in certain minimum principal

amounts, in whole or in part, without premium or penalty, subject to breakage or similar costs. The Company and those

subsidiaries named as borrowers under the Revolving ABL Credit Facility are required to repay the revolving loans in cash and

provide cash collateral under this facility to the extent that the revolving loans and letters of credit exceed the lesser of the

borrowing base then in effect or the aggregate amount of the lenders’ commitments under the Revolving ABL Credit Facility.

During the fiscal year ended February 27, 2016, the Company borrowed $840 and repaid $702 under its Revolving ABL Credit

Facility. During the fiscal year ended February 28, 2015, the Company borrowed $3,268 and repaid $3,268 under the

Revolving ABL Credit Facility. Certain of the Company’s material subsidiaries are co-borrowers under the Revolving ABL

Credit Facility, and this facility is guaranteed by the rest of the Company’s material subsidiaries (the Company and those

subsidiaries named as borrowers and guarantors under the Revolving ABL Credit Facility, the “ABL Loan Parties”). To secure

their obligations under this facility, the ABL Loan Parties have granted a perfected first-priority security interest for the benefit

of the facility lenders in their present and future inventory, credit card, wholesale trade, pharmacy and certain other receivables,

prescription files and related assets. In addition, the obligations under the Revolving ABL Credit Facility are secured by

second-priority liens on and security interests in the collateral securing the Secured Term Loan Facility, subject to certain

limitations to ensure compliance with the Company’s outstanding debt instruments and leases.

Both the Secured Term Loan Facility and the Revolving ABL Credit Facility limit the Company’s ability to make Restricted

Payments (as defined in both the Secured Term Loan Facility and the Revolving ABL Credit Facility), which include dividends

to stockholders. The Secured Term Loan Facility caps the aggregate amount of Restricted Payments that may be made over the

life of the Secured Term Loan Facility. That aggregate cap can fluctuate over time and the cap could be reduced by certain other

actions taken by the Company, including certain debt prepayments and Permitted Investments (as defined in the Secured Term

Loan Facility). As of February 27, 2016, that aggregate cap on Restricted Payments was approximately $401. The Revolving

ABL Credit Facility permits dividends up to $75 per fiscal year, not to exceed $175 in the aggregate over the life of the

Revolving ABL Credit Facility, as long as no Cash Dominion Event (as defined in the Revolving ABL Credit Facility) exists.

Those caps could be reduced by certain debt prepayments made by the Company. The Revolving ABL Credit Facility permits

other Restricted Payments as long as the Payment Conditions (as defined in the Revolving ABL Credit Facility) are met.

Debentures

On January 6, 2016, the Company used borrowings under the Revolving ABL Credit Facility and cash from operations to fund

the redemption of the remaining $278 of 8.00 percent Senior Notes due May 2016 (the "2016 Notes"), and to pay accrued and

unpaid interest on the redeemed 2016 Notes and the applicable redemption premium of approximately $6, which was expensed.

In addition, non-cash charges of $1 for the write-off of the remaining unamortized financing costs on the redeemed 2016 Notes

were incurred.

The $400 of 6.75 percent Senior Notes due June 2021, and the $350 of 7.75 percent Senior Notes due November 2022 contain,

and before their redemption the 2016 Notes contained, operating covenants, including limitations on liens and on sale and

leaseback transactions. The Company was in compliance with all such covenants and provisions for all periods presented.

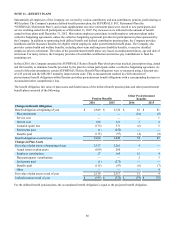

NOTE 8—LEASES

The Company leases most of its retail stores and certain distribution centers, office facilities and equipment from third parties.

Many of these leases include renewal options and, to a limited extent, include options to purchase. Future minimum lease

payments to be made by the Company for noncancellable operating leases and capital leases as of February 27, 2016 consist of

the following: