Albertsons 2016 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Income from Discontinued Operations, Net of Tax

Income from discontinued operations, net of tax, for fiscal 2016 was $8, compared with $72 last year. The $64 decrease in income

from discontinued operations, net of tax is due to net tax benefits of $66 last year primarily related to tangible property repair

regulations and other deduction related changes, property tax refunds and interest income resulting from the settlement of income

tax audits.

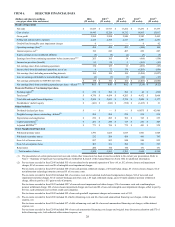

Comparison of fiscal 2015 ended February 28, 2015 and fiscal 2014 ended February 22, 2014:

Net Sales

Net sales for fiscal 2015 were $17,917, compared with $17,252 for fiscal 2014, an increase of $665 or 3.9 percent. The 53rd week

added approximately $313 to Net sales in fiscal 2015. Wholesale net sales were 45.8 percent of Net sales, Save-A-Lot net sales

were 25.8 percent of Net sales, Retail net sales were 27.3 percent of Net sales and Corporate fees earned under the TSA were 1.1

percent of Net sales for fiscal 2015, compared with 47.0 percent, 24.6 percent, 27.0 percent and 1.4 percent, respectively, for

fiscal 2014.

Wholesale net sales for fiscal 2015 were $8,198, compared with $8,102 for fiscal 2014, an increase of $96 or 1.2 percent. The

increase is primarily due to $143 from an additional week of sales in fiscal 2015, and $375 from new accounts, existing customers

and new affiliations, offset in part by $421 from lost accounts, including an NAI banner that completed the transition to self-

distribution part way through the year and the loss of one of the Company's larger customers.

Save-A-Lot net sales for fiscal 2015 were $4,641, compared with $4,255 for fiscal 2014, an increase of $386 or 9.1 percent. The

increase is primarily due to positive network identical store sales of 5.8 percent or $226 (defined as net sales from Company-

operated stores and sales to licensee stores operating for four full quarters, including store expansions and excluding planned store

dispositions), $147 of sales due to new store openings and other revenue and $79 from an additional week of sales in fiscal 2015,

offset in part by a decrease of $67 due to store dispositions by licensees.

Save-A-Lot identical store sales for Company-operated stores (defined as net sales from Company-operated stores operating for

four full quarters, including store expansions and excluding planned store dispositions) were positive 7.6 percent or $127 for

fiscal 2015. Save-A-Lot corporate identical store sales performance was primarily a result of a 5.4 percent increase in customer

count and a 2.1 percent increase in average basket size.

Retail net sales for fiscal 2015 were $4,884 compared with $4,655 for fiscal 2014, an increase of $229 or 4.9 percent. The

increase in Retail net sales was driven by several factors, including a $101 increase in sales due to newly acquired stores, an $87

increase from an additional week of sales in fiscal 2015, a $47 improvement from positive identical store sales of 1.0 percent

(defined as net sales from stores operating for four full quarters, including store expansions and excluding fuel and planned store

dispositions) and $17 of higher fuel sales, offset in part by lower sales from three store closures. Retail positive identical store

sales performance was primarily a result of a 2.4 percent customer count increase, offset in part by a 1.4 percent decrease in

average basket size.

Corporate net sales for fiscal 2015 include fees earned under the TSA of $194, compared with $240 for fiscal 2014, a decrease of

$46. The net sales decrease reflects a one-year transition fee earned under the TSA in fiscal 2014 of $60, offset in part by higher

fees earned during the first quarter of fiscal 2015 due to the timing of the sale of NAI and $4 from an additional week of sales in

fiscal 2015.

Gross Profit

Gross profit for fiscal 2015 was $2,588, compared with $2,540 for fiscal 2014, an increase of $48 or 1.9 percent. Gross profit as a

percent of Net sales was 14.4 percent for fiscal 2015, compared to 14.7 percent in fiscal 2014. TSA fees included within Gross

profit declined by $46, impacting Gross profit as a percent of Net sales by 30 basis points. Fiscal 2014's Gross profit included a

$3 multiemployer pension plan withdrawal charge. The remaining $91 increase in Gross profit is primarily due to $126 of higher

gross profit from increased sales, $12 of lower logistics costs and $9 of lower employee-related costs, offset in part by $33 of

incremental investments to lower prices to customers, higher shrink, stronger private brands' pricing support and other margin

investments, an $18 higher LIFO charge and $12 of higher advertising costs.

Wholesale gross profit was $388 or 4.7 percent of Wholesale net sales for fiscal 2015, compared with $385 or 4.8 percent for

fiscal 2014. Wholesale gross profit for fiscal 2014 included a $3 multiemployer pension plan withdrawal charge. When adjusted

for this item, Wholesale gross profit for fiscal 2015 was approximately flat with fiscal 2014, but included lower logistics and

employee-related costs and higher gross profit from increased sales volume, offset by stronger private brands' pricing support and

other margin investments and a higher LIFO charge.