Albertsons 2016 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

2016 2015 2014

Dividend yield —% —% —%

Volatility rate 49.0 – 56.5% 50.8 – 53.2% 49.3 – 51.3%

Risk-free interest rate 1.2 – 1.4% 1.2 – 1.6% 0.6 – 1.0%

Expected option life 4.0 – 4.0 years 4.0 – 5.0 years 4.0 – 6.0 years

Restricted Stock

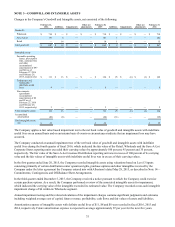

Restricted stock awards and restricted stock unit activity consisted of the following:

Restricted

Stock Units

(In thousands)

Restricted

Stock Awards

(In thousands)

Weighted

Average Grant

Date Fair

Value(1)

Outstanding, February 23, 2013 972 1,443 $ 7.83

Granted 296 491 6.98

Lapsed (1,268)(967) 6.23

Canceled and forfeited — (30) 6.08

Outstanding, February 22, 2014 — 937 9.09

Granted 2,274 18 7.11

Lapsed (133)(417) 6.54

Canceled and forfeited (90)(2) 6.09

Outstanding, February 28, 2015 2,051 536 11.02

Granted 65 2,339 8.74

Lapsed (742)(456) 6.82

Canceled and forfeited (125)(239) 8.79

Outstanding, February 27, 2016 1,249 2,180 $ 8.68

(1) Weighted average grant date fair value is only used for restricted stock awards.

In fiscal 2016, the Company granted 2 shares of restricted stock awards to certain employees under the Company's 2012 Stock

Plan. The restricted stock awards vest over a three year period from the date of the grant.

In fiscal 2015, the Company granted 2 shares of restricted stock units to certain employees under the Company's 2012 Stock

Plan. The restricted stock awards vest over a three year period from the date of the grant.

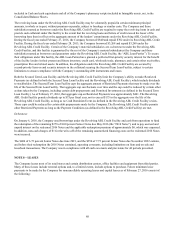

Stock-Based Compensation Expense

The components of pre-tax stock-based compensation expense are included primarily in Selling and administrative expenses in

the Consolidated Statements of Operations. The expense recognized and related tax benefits were as follows:

2016 2015 2014

Stock-based compensation $ 25 $ 23 $ 22

Income tax benefits (10)(9)(8)

Stock-based compensation, net of tax $ 15 $ 14 $ 14

The Company realized excess tax shortfalls of $1, $1 and $1 on the exercise of stock-based awards in fiscal 2016, 2015 and

2014, respectively.

Unrecognized Stock-Based Compensation Expense

As of February 27, 2016, there was $31 of unrecognized compensation expense related to unvested stock-based awards granted

under the Company’s stock plans. The expense is expected to be recognized over a weighted average remaining vesting period

of approximately two years.