Albertsons 2016 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

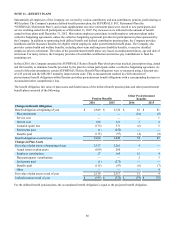

The following is a summary of changes in the fair value of Level 3 investments for 2016 and 2015:

Real Estate

Partnerships Private Equity

Ending balance, February 22, 2014 $ 149 $ 125

Purchases 10 36

Sales (7)(21)

Unrealized gains 10 4

Realized gains and losses — —

Ending balance, February 28, 2015 162 144

Purchases 7 25

Sales (18)(18)

Unrealized gains 9 (10)

Realized gains and losses 4 —

Ending balance, February 27, 2016 $ 164 $ 141

Contributions

In August 2014, the Highway and Transportation Funding Act of 2014, which included an extension of pension funding interest

rate relief, was signed into law. The Highway and Transportation Funding Act includes a provision for interest rate stabilization

for defined benefit employee pension plans. As a result of this stabilization provision, the Company's required pension

contributions to the SUPERVALU Retirement Plan decreased significantly in fiscal 2016 compared to fiscal 2015 and the

Company expects that to continue for the next several years. The Company expects to contribute approximately $30 to $35 to

its defined benefit pension plans and postretirement benefit plans in fiscal 2017.

The Company funds its defined benefit pension plans based on the minimum contribution required under the Employee

Retirement Income Security Act of 1974, as amended, the Pension Protection Act of 2006 and other applicable laws, as

determined by the Company’s external actuarial consultant, and additional contributions made at the Company's discretion. The

Company had agreed to make $100 in aggregate contributions to the SUPERVALU Retirement Plan in excess of the minimum

required contributions pursuant to a term sheet entered into with the Pension Benefit Guarantee Corporation (the “PBGC”) in

connection with the sale of NAI. On September 11, 2014, the Company, AB Acquisition and the PBGC amended the term sheet.

Pursuant to that amendment, the Company made excess contributions of $47 to the SUPERVALU Retirement Plan and the

Company no longer has any obligations or restrictions under the term sheet. The Company will recognize contributions in

accordance with applicable regulations, with consideration given to recognition for the earliest plan year permitted.

At the Company’s discretion, additional funds may be contributed to the pension plan. The Company may accelerate

contributions or undertake contributions in excess of the minimum requirements from time to time subject to the availability of

cash in excess of operating and financing needs or other factors as may be applicable. The Company assesses the relative

attractiveness of the use of cash including such factors as expected return on assets, discount rates, cost of debt, reducing or

eliminating required PBGC variable rate premiums or the ability to achieve exemption from participant notices of

underfunding.

Lump Sum Pension Settlement

During fiscal 2015, the Company made lump sum settlement payments to certain deferred vested pension plan participants

under a lump sum payment option window. The payments were equal to the present value of the participant’s pension benefits,

and were made to certain former employees who were deferred vested participants in the SUPERVALU Retirement Plan, who

had not yet begun receiving monthly pension benefit payments and who elected to participate in the lump sum payment option

window. In fiscal 2015, the SUPERVALU Retirement Plan made lump sum settlement payments of approximately $272. The

lump sum settlement payments resulted in a non-cash pension settlement charge of $64 from the acceleration of a portion of the

accumulated unrecognized actuarial loss. As a result of the lump sum settlements, the SUPERVALU Retirement Plan assets and

liabilities were re-measured at November 29, 2014 using a discount rate of 4.1 percent, an expected rate of return on plan assets

of 6.5 percent and the RP-2014 Generational Mortality Table. The November 29, 2014 re-measurement resulted in an increase

to Accumulated other comprehensive loss of $200 pre-tax ($141 after-tax) and a corresponding decrease to the SUPERVALU

Retirement Plan's funded status.