Albertsons 2016 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

Benefit Plans

The Company recognizes the funded status of its Company-sponsored defined benefit plans in its Consolidated Balance Sheets

and gains or losses and prior service costs or credits not yet recognized as a component of Accumulated other comprehensive

income (loss), net of tax, in the Consolidated Balance Sheets. The Company sponsors pension and other postretirement plans in

various forms covering substantially all employees who meet eligibility requirements. The determination of the Company’s

obligation and related expense for Company-sponsored pension and other postretirement benefits is dependent, in part, on

management’s selection of certain actuarial assumptions in calculating these amounts. These assumptions include, among other

things, the discount rate, the expected long-term rate of return on plan assets and the rates of increase in healthcare and

compensation costs. These assumptions are disclosed in Note 11—Benefit Plans. Actual results that differ from the assumptions

are accumulated and amortized over future periods in accordance with generally accepted accounting standards.

Effective for fiscal 2017, the Company adopted an alternative approach for determining the interest and service cost

components of net periodic benefit cost for defined benefit pension and other postretirement benefit plans. The Company has

elected to use the full yield curve approach in the estimation of these components of net periodic benefit cost effective in fiscal

2017 by applying the specific spot rates along the yield curve used in the determination of the projected benefit obligation to

the relevant projected cash flows. The change does not affect the measurement of the total benefit obligation. See Note 11—

Benefit Plans for additional information on the impact of the change in estimate.

The Company contributes to various multiemployer pension plans under collective bargaining agreements, primarily defined

benefit pension plans. Pension expense for these plans is recognized as contributions are funded. See Note 11—Benefit Plans

for additional information on the Company’s participation in multiemployer plans.

The Company also contributes to an employee 401(k) retirement savings plan.

Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. Assets and liabilities recorded at fair value are categorized using defined

hierarchical levels directly related to the amount of subjectivity associated with the inputs to fair value measurements, as

follows:

Level 1 - Quoted prices in active markets for identical assets or liabilities;

Level 2 - Inputs other than quoted prices included within Level 1 that are either directly or indirectly observable;

Level 3 - Unobservable inputs in which little or no market activity exists, requiring an entity to develop its own

assumptions that market participants would use to value the asset or liability.

The Company utilized fair value measurements in reporting results of operation and financial position within its Consolidated

Financial Statements for the following:

• Acquired assets and liabilities discussed in Note 2—Business Acquisitions were measured at fair value using Level 3

inputs.

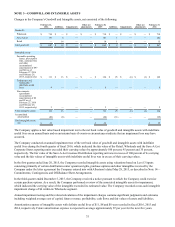

• Acquired intangible assets and intangible asset impairment charges discussed in Note 3—Goodwill and Intangible Assets

were measured at fair value using Level 3 inputs.

• Impairment charges related to lease reserves and properties held and used and held for sale, as discussed in Note 4—

Reserves for Closed Properties and Property, Plant and Equipment-related Impairment Charges, were measured at fair

value using Level 3 inputs.

• Assets and liabilities measured at fair value on a recurring basis using Level 1 and Level 2 inputs as discussed in Note 6

—Fair Value Measurements.

• Stock-based compensation awards were measured at their grant date fair value upon issuance using Level 3 inputs as

discussed in Note 10—Stock-based Awards.

• Discontinued operations property, plant and equipment impairment charges and finalization adjustments related to the sale

of NAI were recorded in Income from discontinued operations, net of tax, as discussed in Note 16—Discontinued

Operations, and were measured at fair value using Level 3 inputs.

Derivatives

The Company uses derivatives only to manage well-defined risks. The Company does not use financial instruments or

derivatives for any trading or other speculative purposes.

Interest rate swap contracts are entered into to mitigate the Company's exposure to changes in market interest rates. These

contracts are reviewed for hedging effectiveness at hedge inception and on an ongoing basis. If these contracts are designated