Albertsons 2016 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

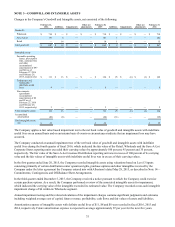

NOTE 4—RESERVES FOR CLOSED PROPERTIES AND PROPERTY, PLANT AND EQUIPMENT-RELATED

IMPAIRMENT CHARGES

Reserves for Closed Properties

Changes in the Company’s reserves for closed properties consisted of the following:

2016 2015 2014

Beginning balance $ 34 $ 47 $ 61

Additions 8 4 4

Payments (12)(12)(16)

Adjustments (1)(5)(2)

Ending balance $ 29 $ 34 $ 47

In fiscal 2016, the Company determined it would close 15 non-strategic Save-A-Lot corporate stores and recorded an

impairment charge of $5 related to the operating leases for these stores in the Save-A-Lot segment.

Property, Plant and Equipment Impairment Charges

The following table presents impairment charges related to property, plant and equipment measured at fair value on a non-

recurring basis:

2016 2015 2014

Property, plant and equipment:

Carrying value $ 11 $ 4 $ 45

Fair value measured using Level 3 inputs 3 1 21

Impairment charge $ 8 $ 3 $ 24

Fiscal 2016 and 2015 impairment charges are primarily related to the closure of non-strategic Save-A-Lot corporate stores.

Fiscal 2014 impairment charges were primarily related to the write-off of certain software tools that would no longer be utilized

in operations within Retail, and impairments of Wholesale distribution centers and Save-A-Lot stores.

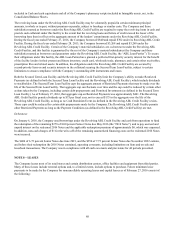

NOTE 5—PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment, net, consisted of the following:

2016 2015

Land $ 104 $ 104

Buildings 1,295 1,252

Property under construction 79 71

Leasehold improvements 722 709

Equipment 2,082 2,021

Capitalized lease assets 294 314

Total property, plant and equipment 4,576 4,471

Accumulated depreciation (2,897)(2,779)

Accumulated amortization on capitalized lease assets (198)(222)

Total property, plant and equipment, net $ 1,481 $ 1,470

Depreciation expense was $248, $258 and $275 for fiscal 2016, 2015 and 2014, respectively. Amortization expense related to

capitalized lease assets was $18, $19 and $19 for fiscal 2016, 2015 and 2014, respectively.