Albertsons 2016 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

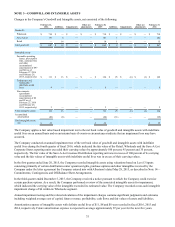

Goodwill

The Company reviews goodwill for impairment during the fourth quarter of each year, and also if events occur or

circumstances change that would more-likely-than-not reduce the fair value of a reporting unit below its carrying value. The

reviews consist of comparing estimated fair value to the carrying value at the reporting unit level. For Wholesale and Retail, the

Company’s reporting units are the operating segments of the business, which consist of Wholesale and Retail. Goodwill was

assigned to these reporting units as of the acquisition date, with no amounts being allocated between reporting units. For Save-

A-Lot, the reporting units are the components of the business: Licensee Distribution and Corporate Stores. Goodwill has been

allocated between the Save-A-Lot reporting units on a relative fair value basis. Fair values are determined by using both the

market approach, applying a multiple of earnings and revenue based on guidelines for publicly traded companies, and the

income approach, discounting projected future cash flows based on management’s expectations of the current and future

operating environment. The rates used to discount projected future cash flows reflect a weighted average cost of capital based

on the Company’s industry, capital structure and risk premiums in each reporting unit, including those reflected in the current

market capitalization. If management identifies the potential for impairment of goodwill, the implied fair value of the goodwill

is calculated as the difference between the fair value of the reporting unit and the fair value of the underlying assets and

liabilities, excluding goodwill. An impairment charge is recorded for any excess of the carrying value over the implied fair

value.

The Company reviews the composition of its reporting units on an annual basis and on an interim basis if events or

circumstances indicate that the composition of the Company’s reporting units may have changed. During the fiscal 2016

review, the Company separated the Save-A-Lot reporting unit into the Licensee Distribution and Corporate Stores reporting

units. There were no changes in the Company’s reporting units as a result of the fiscal 2015 review.

Intangible Assets, Net

The Company reviews intangible assets with indefinite useful lives, which primarily consist of trademarks and tradenames, for

impairment during the fourth quarter of each year, and also if events or changes in circumstances indicate that the asset might

be impaired. The reviews consist of comparing estimated fair value to the carrying value. Fair values of the Company’s

trademarks and tradenames are determined primarily by discounting an assumed royalty value applied to management’s

estimate of projected future revenues associated with the tradename using management’s expectations of the current and future

operating environment. The royalty cash flows are discounted using rates based on the weighted average cost of capital

discussed above and the specific risk profile of the tradenames relative to the Company’s other assets. These estimates are

impacted by variable factors, including inflation, the general health of the economy and market competition. The impairment

review calculation contains significant judgments and estimates, including the weighted average cost of capital, any specified

risk profile of the tradename, and future revenue and profitability. See Note 3—Goodwill and Intangible Assets for additional

information.

Impairment of Long-Lived Assets

The Company monitors the recoverability of its long-lived assets such as buildings and equipment, and evaluates their carrying

value for impairment whenever events or changes in circumstances indicate that the carrying value of such assets may not be

fully recoverable. Events that may trigger such an evaluation include current period losses combined with a history of losses or

a projection of continuing losses, a significant decrease in the market value of an asset or the Company’s plans for store

closures. When such events or changes in circumstances occur, a recoverability test is performed by comparing projected

undiscounted future cash flows to the carrying value of the group of assets being tested.

If impairment is identified for long-lived assets to be held and used, the fair value is compared to the carrying value of the

group of assets and an impairment charge is recorded for the excess of the carrying value over the fair value. For long-lived

assets that are classified as assets held for sale, the Company recognizes impairment charges for the excess of the carrying

value plus estimated costs of disposal over the estimated fair value. Fair value is based on current market values or discounted

future cash flows using Level 3 inputs. The Company estimates fair value based on the Company’s experience and knowledge

of the market in which the property is located and, when necessary, utilizes local real estate brokers. The Company’s estimate

of undiscounted cash flows attributable to the asset groups includes only future cash flows that are directly associated with and

that are expected to arise as a direct result of the use and eventual disposition of the asset group. Long-lived asset impairment

charges are a component of Selling and administrative expenses in the Consolidated Statements of Operations.

The Company groups long-lived assets with other assets at the lowest level for which identifiable cash flows are largely

independent of the cash flows of other assets, which historically has predominately been at the geographic market level for

retail stores, but individual store asset groupings have been assessed in certain circumstances. Wholesale’s long-lived assets are

reviewed for impairment at the distribution center level. Save-A-Lot’s long-lived assets are reviewed for impairment at the

geographic market level for 13 geographic market groupings of individual corporate-owned stores and related dedicated