Albertsons 2016 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

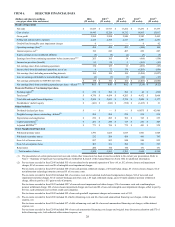

A pre-tax item recorded in fiscal 2013 included $22 of non-cash unamortized financing charges within interest expense, net.

(4) Working capital of continuing operations is calculated using the first-in, first-out method (“FIFO”), after adding back the last-in, first-out method

(“LIFO”) reserve. The LIFO reserve for each year is as follows: $215 for fiscal 2016, $211 for fiscal 2015, $202 for fiscal 2014, $211 for fiscal 2013

and $207 for fiscal 2012. Current assets of discontinued operations at the end of each fiscal year were as follows: $0 for fiscal 2016, 2015 and 2014,

$1,494 for fiscal 2013 and $1,616 for fiscal 2012. Current liabilities of discontinued operations at the end of each fiscal year were as follows: $0 for

fiscal 2016, 2015 and 2014, $2,701 for fiscal 2013 and $1,606 for fiscal 2012.

(5) Total assets of continuing operations are calculated as Total assets of the Company excluding current assets and long-term assets of discontinued

operations.

(6) Weighted average shares outstanding—diluted, as presented here, represents the diluted weighted average shares outstanding utilized in the

computation of Net earnings (loss) from continuing operations per share—diluted.

(7) Capital expenditures include cash payments for purchases of property, plant and equipment and non-cash capital lease additions, and exclude cash

payments for business acquisitions.

(8) Adjusted EBITDA is a non-GAAP financial measure that the Company provides as a supplement to our results of operations and related analysis, and

should not be considered superior to, a substitute for or an alternative to any financial measure of performance prepared and presented in accordance

with GAAP (defined below). Refer to the “Non-GAAP Financial Measures” section of Part II, Item 7 of this Annual Report on Form 10-K for a

reconciliation to the applicable GAAP financial measure and additional information regarding the Company’s use of non-GAAP financial measures.

Historical data is not necessarily indicative of the Company’s future results of operations or financial condition. See discussion

of “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.