Albertsons 2016 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

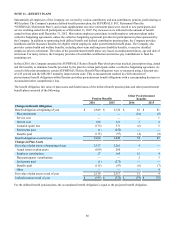

Estimated Future Benefit Payments

The estimated future benefit payments to be made from the Company’s defined benefit pension and other postretirement benefit

plans, which reflect expected future service, are as follows:

Fiscal Year Pension Benefits Other Postretirement

Benefits

2017 $ 154 $ 4

2018 135 4

2019 140 4

2020 148 4

2021 158 4

Years 2022-2026 843 20

Defined Contribution Plans

The Company sponsors defined contribution and profit sharing plans pursuant to Section 401(k) of the Internal Revenue Code.

Employees may contribute a portion of their eligible compensation to the plans on a pre-tax basis. The Company matches a

portion of employee contributions by contributing cash into the investment options selected by the employees. The total amount

contributed by the Company to the plans is determined by plan provisions or at the discretion of the Company. Total employer

contribution expenses for these plans were $8, $16 and $11 for fiscal 2016, 2015 and 2014, respectively. Matching

contributions were reduced or eliminated in January 2013 for most employees. The Company adopted and made a discretionary

match for fiscal 2015 for employees who had their matching contributions eliminated. There were no discretionary matches

made in fiscal 2016. Since June 2014, plan investment options do not include shares of the Company's common stock.

Post-Employment Benefits

The Company recognizes an obligation for benefits provided to former or inactive employees. The Company is self-insured for

certain disability plan programs, which comprise the primary benefits paid to inactive employees prior to retirement.

Amounts recognized in the Consolidated Balance Sheets consisted of the following:

Post-Employment Benefits

2016 2015

Accrued vacation, compensation and benefits $ 5 $ 8

Other long-term liabilities 8 10

Total $ 13 $ 18

Multiemployer Plans

The Company contributes to various multiemployer pension plans under collective bargaining agreements, primarily defined

benefit pension plans. These multiemployer plans generally provide retirement benefits to participants based on their service to

contributing employers. The benefits are paid from assets held in trust for that purpose. Plan trustees typically are responsible

for determining the level of benefits to be provided to participants as well as the investment of the assets and plan

administration. Trustees are appointed in equal number by employers and the unions that are parties to the collective bargaining

agreement.

Expense is recognized in connection with these plans as contributions are funded, in accordance with U.S. generally accepted

accounting standards. The Company contributed $43, $39 and $39 to these plans for fiscal years 2016, 2015 and 2014,

respectively. The risks of participating in these multiemployer plans are different from the risks associated with single-employer

plans in the following respects:

a. Assets contributed to the multiemployer plan by one employer are held in trust and may be used to provide benefits to

employees of other participating employers.

b. If a participating employer stops contributing to the plan, the unfunded obligations of the plan may be borne by the

remaining participating employers.

c. If the Company chooses to stop participating in some multiemployer plans, or makes market exits or store closures or

otherwise has participation in the plan drop below certain levels, the Company may be required to pay those plans an

amount based on the underfunded status of the plan, referred to as a withdrawal liability.