Albertsons 2016 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

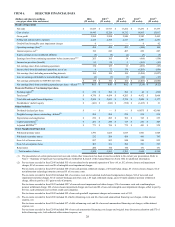

Save-A-Lot operating earnings for fiscal 2016 were $129, or 2.8 percent of Save-A-Lot net sales, compared with $153, or 3.3

percent last year. Save-A-Lot operating earnings for fiscal 2016 include $11 of store closure and impairment charges and $2 of

severance costs. Save-A-Lot operating earnings for last year included store closure and impairment charges of $3. The additional

week in fiscal 2015 contributed approximately $4 to Save-A-Lot operating earnings. When adjusted for these items, the

remaining $10 decrease in Save-A-Lot operating earnings is primarily due to $16 of higher occupancy costs primarily driven by a

higher number of corporate stores, $16 of higher employee-related costs primarily driven by a higher number of corporate stores,

$6 of higher depreciation expense, $4 of higher inventory shrink costs and $4 of higher contracted services costs, offset in part by

$19 of higher base margins driven by a higher mix of corporate stores relative to licensee stores and product costs declining faster

than retail prices, $10 of higher gross profit from higher sales, $8 of lower logistics costs and $4 of higher trucking back-haul

income.

Retail operating earnings for fiscal 2016 were $94, or 2.0 percent of Retail net sales, compared with $122, or 2.5 percent last year.

Retail operating earnings for fiscal 2016 include $1 of store closure and impairment charges. The additional week in fiscal 2015

contributed approximately $7 to Retail operating earnings. When adjusted for these items, the remaining $20 decrease in Retail

operating earnings is primarily due to $21 of higher employee-related costs primarily driven by new retail stores, $14 of higher

inventory shrink costs, $7 of lower gross profit from lower sales and $4 of higher occupancy costs, offset in part by $14 of lower

depreciation expense, $7 of higher base margins and $6 of lower logistics costs.

Corporate operating earnings for fiscal 2016 were $1, compared with an operating loss of $94 for last year. Corporate expenses

for fiscal 2016 include $15 of costs related to the potential separation of Save-A-Lot and $6 of severance costs. Corporate

expenses for fiscal 2015 included $64 of non-cash pension settlement charges, a $5 benefit plan charge and $2 of information

technology intrusion costs, net of insurance recoverable. The additional week in fiscal 2015 contributed expense of approximately

$1 to Corporate operating loss. When adjusted for these items, the remaining $44 net increase in Corporate operating earnings

was primarily due to $37 of lower employee-related costs, primarily due to lower benefits and entity-wide incentive

compensation, $12 of higher transition service agreement fees and $10 of lower occupancy costs, offset in part by $12 of higher

pension expense and $6 of higher administrative expenses.

Interest Expense, Net

Interest expense, net for fiscal 2016 was $196, compared with $243 last year. Interest expense, net for fiscal 2016 includes $6 of

debt refinancing costs related to the redemption of the remaining $278 of the Company's outstanding 8.00 percent Senior Notes

due May 2016 (the "2016 Notes") and $4 of non-cash unamortized financing cost charges related to the 2016 Notes redemption

and the amendment to the Revolving ABL Credit Facility. Interest expense for last year included $37 of debt refinancing costs

related to the redemption of $350 of the 2016 Notes and costs related to the incremental carry costs of the 7.75 percent Senior

Notes due November 2022 (the “2022 Notes”) outstanding during the 2016 Notes 30-day redemption period, and $6 of non-cash

unamortized financing cost charges related to the 2016 Notes redemption and the amendments to the Revolving ABL Credit

Facility. The additional week in fiscal 2015 contributed additional interest expense of approximately $3. When adjusted for these

items, the remaining $11 decrease in Interest expense, net is primarily due to lower average outstanding debt balances.

Income Tax Provision

Income tax expense on earnings from continuing operations for fiscal 2016 was $85, or 32.3 percent of earnings from continuing

operations before income taxes, compared with $58, or 31.2 percent last year. The increase in the effective tax rate is primarily

due to the pension settlement charge included in the prior year, partially offset by a favorable mix of income in state tax

jurisdictions in the current year.

Net Earnings from Continuing Operations

Net earnings from continuing operations for fiscal 2016 were $178, compared with $127 last year. Net earnings from continuing

operations for fiscal 2016 include $34 of after-tax charges and costs related to costs for the potential Save-A-Lot separation, store

closure and impairment charges, severance costs, intangible asset impairment charges, debt refinancing costs and unamortized

financing cost charges as discussed above. Net earnings from continuing operations for last year included $70 of after-tax charges

and costs related to the non-cash pension settlement charges, debt refinancing costs, unamortized financing cost charges, store

closure and impairment charges, a benefit plan charge, net information technology intrusion costs and severance costs as

discussed above. The additional week in fiscal 2015 contributed approximately $8 to Net earnings from continuing operations.

When adjusted for these items, the remaining $23 after-tax increase in Net earnings from continuing operations is primarily due to

the variances as discussed in the Operating Earnings, Interest Expense, Net, and Income Tax Provision sections above.