Albertsons 2016 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

At the discretion of the Board of Directors or the Compensation Committee, the Company has granted stock options to

purchase common stock at an exercise price not less than 100 percent of the fair market value of the Company’s common stock

on the date of grant, restricted stock awards, restricted stock units and performance awards to executive officers and other key

salaried employees. Stock options have also been granted to the Company’s non-employee directors. Prior to fiscal 2013, stock

options vested over four years and starting in fiscal 2013, stock options vest over three years. The vesting of restricted stock

awards and restricted stock units is determined at the discretion of the Board of Directors or the Compensation Committee. The

restrictions on the restricted stock awards and restricted stock units generally lapse between one and five years from the date of

grant and the expense is recognized over the period during which the restrictions expire.

As of February 27, 2016, there were 18 shares available for future issuance of stock-based awards under the 2012 Stock Plan.

Common stock has been delivered out of treasury stock or newly issued shares upon the exercise or vesting of stock-based

awards. The provisions of future stock-based awards may change at the discretion of the Board of Directors or the

Compensation Committee.

On March 20, 2013, the Company completed the Tender Offer and issued common stock to Symphony Investors, which the

Company’s Board of Directors deemed to be a change-in-control for purposes of the Company’s outstanding stock-based

awards, immediately accelerating the vesting of certain stock-based awards. The Company recognized $9 of accelerated stock-

based compensation charges in Selling and administrative expenses in fiscal 2014 as a result of the deemed change-in-control,

comprised of $5 from long-term incentive programs, $3 from restricted stock awards and $1 from stock options.

Stock Options

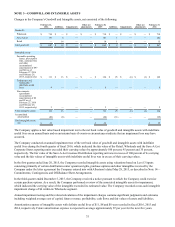

Stock options granted, exercised and outstanding consisted of the following:

Shares

Under Option

(In thousands)

Weighted

Average

Exercise Price

Weighted Average

Remaining

Contractual Term

(In years)

Aggregate

Intrinsic Value

(In thousands)

Outstanding, February 23, 2013 22,246 $ 19.20 4.63 $ 10,402

Granted 10,083 6.58

Exercised (3,121) 2.29

Canceled and forfeited (5,873) 23.70

Outstanding, February 22, 2014 23,335 14.87 5.41 $ 15,982

Granted 5,022 7.54

Exercised (1,944) 3.71

Canceled and forfeited (5,533) 30.68

Outstanding, February 28, 2015 20,880 9.98 6.55 $ 61,073

Granted 5,531 7.44

Exercised (1,723) 5.84

Canceled and forfeited (3,336) 24.94

Outstanding, February 27, 2016 21,352 $ 7.37 5.93 $ 6,827

Vested and expected to vest in the future as of

February 27, 2016 20,089 $ 7.39 5.77 $ 6,558

Exercisable as of February 27, 2016 10,888 $ 7.48 4.28 $ 5,722

For the Company's annual grant made in the first quarter of fiscal 2016, 2015 and 2014, the Company granted 4, 5 and 9,

respectively, of non-qualified stock options to certain employees under the Company’s 2012 Stock Plan with a weighted

average grant date fair value of $3.67, $3.28 and $2.78 per share, respectively. These stock options vest over a period of three

years, and were awarded as part of a broad-based employee incentive initiative designed to retain and motivate employees

across the Company.

In fiscal 2016, the Company's Board of Directors granted 2 stock options to the Company's Chief Executive Officer. The stock

options have a grant date fair value of $2.08 per share and vest over three years.

The Company used the Black Scholes option pricing model to estimate the fair value of the options at grant date based upon the

following assumptions: