Albertsons 2016 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

2016 2015 2014

Net sales $ — $ — $ 1,235

(Loss) income before income taxes from discontinued operations (1) 6 121

Income tax benefit (9)(66)(55)

Income from discontinued operations, net of tax $ 8 $ 72 $ 176

Income from discontinued operations, net of tax for fiscal 2016 primarily reflects tax settlement matters, including discrete tax

benefits and expenses, and pre-tax resolution matters.

Income before income taxes from discontinued operations for fiscal 2015 primarily reflects $6 of property tax refunds and

interest income resulting from settlement of income tax audits. The income tax benefit included as a component of Income

from discontinued operations, net of tax for fiscal 2015 includes $66 of net tax benefits, primarily related to tangible property

repair regulations and other deduction-related changes.

The tax rate for the income tax benefit included as a component of Income from discontinued operations, net of tax for fiscal

2014 included $105 of discrete tax benefits primarily resulting from the settlement of IRS audits for the fiscal 2010, 2009 and

2008 tax years and an adjustment to decrease the loss on sale of NAI reported at February 23, 2013.

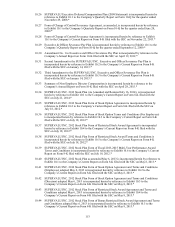

UNAUDITED QUARTERLY FINANCIAL INFORMATION

(In millions, except per share data)

Unaudited quarterly financial information for SUPERVALU INC. and subsidiaries is as follows:

2016

First

(16 weeks) Second

(12 weeks) Third

(12 weeks) Fourth

(12 weeks) Fiscal Year

(52 weeks)

Net sales $ 5,407 $ 4,062 $ 4,114 $ 3,946 $ 17,529

Gross profit $ 810 $ 583 $ 601 $ 590 $ 2,584

Net earnings from continuing operations(1) $ 63 $ 31 $ 35 $ 49 $ 178

Net earnings attributable to SUPERVALU INC. $ 61 $ 31 $ 34 $ 52 $ 178

Net earnings per share from continuing operations

attributable to SUPERVALU INC.—diluted(1) $ 0.23 $ 0.11 $ 0.13 $ 0.18 $ 0.63

Net earnings per share attributable to SUPERVALU INC.

—diluted $ 0.23 $ 0.11 $ 0.13 $ 0.20 $ 0.66

Dividends declared per share $ — $ — $ — $ — $ —

Weighted average shares—diluted 268 268 268 267 268

2015

First

(16 weeks) Second

(12 weeks) Third

(12 weeks) Fourth

(13 weeks) Fiscal Year

(53 weeks)

Net sales $ 5,264 $ 4,041 $ 4,225 $ 4,387 $ 17,917

Gross profit $ 755 $ 574 $ 596 $ 663 $ 2,588

Net earnings from continuing operations(2) $ 48 $ 31 $ 12 $ 36 $ 127

Net earnings attributable to SUPERVALU INC. $ 43 $ 31 $ 79 $ 39 $ 192

Net earnings per share from continuing operations

attributable to SUPERVALU INC.—diluted(2) $ 0.18 $ 0.11 $ 0.04 $ 0.13 $ 0.45

Net earnings per share attributable to SUPERVALU INC.

—diluted $ 0.17 $ 0.11 $ 0.30 $ 0.14 $ 0.73

Dividends declared per share $ — $ — $ — $ — $ —

Weighted average shares—diluted 262 264 265 266 264

(1) Results from continuing operations for the fiscal year ended February 27, 2016 include net charges and costs of $51 before tax ($34

after tax, or $0.13 per diluted share). Refer to Item 6 Selected Financial Data in Part II, Item 8 of this Annual Report on Form 10-K for

a discussion of these items.