Albertsons 2016 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

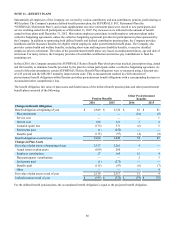

entered into to reduce the Company's exposure to changes in market interest rates associated with its variable rate debt. The

Company designated this derivative as a cash flow hedge of the variability in expected cash outflows for interest payments.

In fiscal 2016 and 2015, no amounts were recorded in the Consolidated Statements of Operations for interest rate swap

derivative ineffectiveness or reclassifications from Accumulated other comprehensive loss into earnings.

The fair value of the interest rate swap is measured using Level 2 inputs. The interest rate swap agreement is valued using an

income approach interest rate swap valuation model incorporating observable market inputs including interest rates, LIBOR

swap rates and credit default swap rates. As of February 27, 2016, a 100 basis point increase in forward LIBOR interest rates

would increase the fair value of the interest rate swap by approximately $6; and a 100 basis point decrease in forward LIBOR

interest rates would decrease the fair value of the interest rate swap by approximately $3.

The Company utilized Level 3 fair value inputs in measuring certain non-recurring transactions in fiscal 2016. See Note 1—

Summary of Significant Accounting Policies.

Fair Value Estimates

For certain of the Company’s financial instruments, including cash and cash equivalents, receivables, accounts payable, accrued

salaries and other current assets and liabilities, the fair values approximate carrying values due to their short maturities.

The estimated fair value of notes receivable was greater than the carrying value by $1 and $2 as of February 27, 2016 and

February 28, 2015, respectively. The estimated fair value of notes receivable was calculated using a discounted cash flow

approach applying a market rate for similar instruments using Level 3 inputs.

The estimated fair value of the Company’s long-term debt was less than the carrying amount, excluding debt financing costs,

by approximately $236 as of February 27, 2016 and greater than the carrying amount by approximately $59 as of February 28,

2015. The estimated fair value was based on market quotes, where available, or market values for similar instruments, using

Level 2 and 3 inputs.

NOTE 7—LONG-TERM DEBT

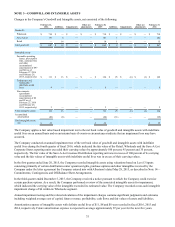

The Company’s long-term debt consisted of the following:

February 27,

2016 February 28,

2015

4.50% Secured Term Loan Facility due March 2019 $ 1,459 $ 1,469

6.75% Senior Notes due June 2021 400 400

7.75% Senior Notes due November 2022 350 350

8.00% Senior Notes due May 2016 — 278

1.93% to 4.00% Revolving ABL Credit Facility due February 2021 138 —

Debt financing costs, net (45)(35)

Original issue discount on debt (5)(8)

Total debt 2,297 2,454

Less current maturities of long-term debt (100)(9)

Long-term debt $ 2,197 $ 2,445

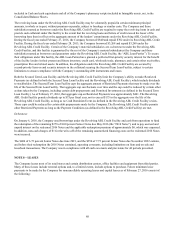

Future maturities of long-term debt, excluding the original issue discount on debt and debt financing costs, as of February 27,

2016, consist of the following:

Fiscal Year

2017 $ 102

2018 —

2019 —

2020 1,357

2021 138

Thereafter 750