Albertsons 2016 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

Revisions

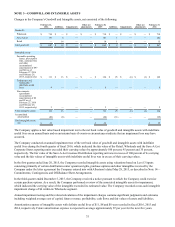

In the first quarter of fiscal 2016, the Company completed an assessment of its revenue and expense presentation primarily

related to professional services and certain other transactions. Expenses related to transactions in which the Company

determined it was the principal were previously presented net of related revenues within Net sales in the Consolidated

Statements of Operations. The presentation of these expenses has been revised to include them within Cost of sales and Selling

and administrative expenses. These revisions had the effect of increasing Net sales with a corresponding increase to Cost of

sales and Selling and administrative expenses. These revisions did not impact Operating earnings, Earnings from continuing

operations before income taxes, Net earnings attributable to SUPERVALU INC., cash flows, or financial position for any

period reported. These revisions have similarly impacted the Company's Consolidated Financial Statements across fiscal

periods. Management determined that these revisions are not material to any period reported. Prior period amounts have been

revised to conform to the current period presentation as shown below.

The following tables present the impact of these revisions on the Company's previously reported results, and the revised

amounts as reported in this Annual Report on Form 10-K:

February 28, 2015

(53 weeks) February 22, 2014

(52 weeks)

As

Originally

Reported Revision As Revised

As

Originally

Reported Revision As Revised

Net sales $ 17,820 $ 97 $ 17,917 $ 17,153 $ 99 $ 17,252

Cost of sales 15,242 87 15,329 14,623 89 14,712

Gross profit 2,578 10 2,588 2,530 10 2,540

Selling and administrative expenses 2,154 10 2,164 2,107 10 2,117

Operating earnings $ 424 $ — $ 424 $ 423 $ — $ 423

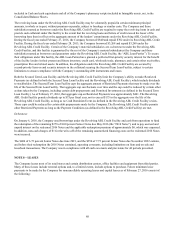

February 28, 2015

(53 weeks) February 22, 2014

(52 weeks)

As

Originally

Reported Revision As Revised

As

Originally

Reported Revision As Revised

Net sales

Wholesale $ 8,134 $ 64 $ 8,198 $ 8,036 $ 66 $ 8,102

% of total 45.6% 0.2 % 45.8% 46.9% 0.1 % 47.0%

Save-A-Lot 4,613 28 4,641 4,228 27 4,255

% of total 25.9% (0.1)% 25.8% 24.6% — % 24.6%

Retail 4,879 5 4,884 4,649 6 4,655

% of total 27.4% (0.1)% 27.3% 27.1% (0.1)% 27.0%

Corporate 194 — 194 240 — 240

% of total 1.1% — % 1.1% 1.4% — % 1.4%

Total net sales $ 17,820 $ 97 $ 17,917 $ 17,153 $ 99 $ 17,252

100.0% — % 100.0% 100.0% — % 100.0%

Reclassifications

In fiscal 2016, losses on the early termination of debt are included in the Consolidated Statements of Cash Flows as a separate

line item entitled Loss on debt extinguishment. In prior years, losses on the early termination of debt were classified as Asset

impairment and other charges. Prior year amounts have been reclassified to conform to current year presentation. These

reclassifications did not impact net cash provided by operating activities or net cash from investing activities or financing

activities for any period presented.