Yahoo 1998 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

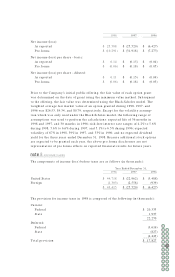

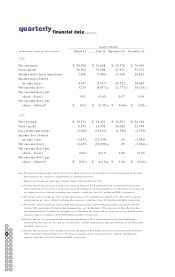

quarterlyfinancial data(unaudited)

Quarter Ended

(in thousands, except per share amounts) March 31 J une 30 September 30 December 31

1998

Net revenues $ 30,596 $ 41,688 $ 54,576 $ 76,410

Gross profit 26,302 35,904 47,051 67,271

Income (loss) from operations 2,658 (7,860) 13,146 20,824

Income (loss) before

income taxes 4,341 (5,917) 18,322 26,669

Net income (loss) 3,270 (8,977)(a) 12,771(b) 18,524(c)

Net income (loss) per

share – basic*0.02 (0.05) 0.07 0.09

Net income (loss) per

share – diluted*$ 0.02 $ (0.05)(a) $ 0.06(b) $ 0.08 (c)

1997

Net revenues $ 10,731 $ 14,432 $ 18,703 $ 26,584

Gross profit 8,835 11,908 16,028 22,794

Loss from operations (3,029) (23,641) (1,320) (2,792)

Income (loss) before

income taxes (1,435) (22,209) 65 (1,941)

Net income (loss) (1,435) (22,209)(d) 65 (1,941)(e)

Net income (loss) per

share – basic*(0.01) (0.13) 0.00 (0.01)

Net income (loss) per

share – diluted* $ (0.01) $ (0.13)(d) $ 0.00 $ (0.01)(e)

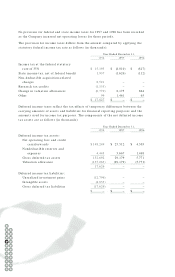

Note: The quarterly financial data for the quarters presented above has been restated to reflect the acquisition of Yoyodyne

Entertainment, Inc. which was accounted for as a pooling of interests.

* Reflects the two-for-one stock splits effective August 1998 and February 1999.

(a) Net loss and net loss per share include a non-recurring charge of $15.0 million incurred in connection with the J une

1998 acquisition of Viaweb Inc. and amortization of $0.7 million on related intangible assets. Pro forma net income and

net income per share - diluted, excluding these expenses, would have been $6.7 million and $0.03, respectively.

(b) Net income and net income per share include amortization of $2.1 million on intangible assets. Pro forma net income

and net income per share - diluted, excluding these expenses, would have been $14.9 million and $0.06, respectively.

(c) Net income and net income per share include non-recurring charges of $4.4 million incurred in connection with the

October 1998 acquisition of Yoyodyne Entertainment, Inc. and the December 1998 acquisition of HyperParallel, Inc.,

and amortization of $2.1 million on intangible assets. Pro forma net income and net income per share - diluted, exclud-

ing these expenses, would have been $25.0 million and $0.11, respectively.

(d) Net loss and net loss per share include a non-recurring charge of $21.2 million related to the Yahoo! Marketplace

restructuring. Pro forma net loss and net loss per share - diluted, excluding this expense, would have been $1.0 million

and $0.01, respectively.

(e) Net loss and net loss per share include a non-recurring charge of $3.9 million incurred in connection with the October

1997 acquisition of Four11 Corporation. Pro forma net income and net income per share - diluted, excluding this

expense, would have been $1.9 million and $0.01, respectively.

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62