Yahoo 1998 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

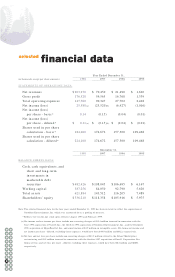

General and Administrative. General and administrative expenses were $11.2

million, or 6% of net revenues for the year ended December 31, 1998 compared to

$7.4 million and $5.8 million, or 10% and 27% of net revenues for the years ended

December 31, 1997 and 1996, respectively. General and administrative expenses

consist primarily of compensation and fees for professional services, and the year-

to-year increases in absolute dollars are primarily attributable to increases in

these areas. The Company believes that the absolute dollar level of general and

administrative expenses will increase in future periods, as a result of an increase

in personnel and increased fees for professional services. As a percentage of net

revenues, the Company currently anticipates that general and administrative

expenses will approximate 5% during 1999, however, anticipated spending levels

may vary as a result of acquisitions and future business combinations.

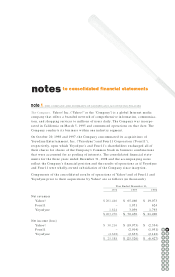

Amortization of Intangibles. As part of the Viaweb acquisition, the Company

recorded an intangible asset related to goodwill in the amount of $24.3 million.

This asset is being amortized over a seven-year period beginning in June 1998.

Other – Non-recurring Costs. During June 1998, the Company completed the acquisi-

tion of all outstanding shares of Viaweb through the issuance of 1,574,364 shares of

Yahoo! Common Stock. All outstanding options to purchase Viaweb common stock

were converted into options to purchase 244,504 shares of Yahoo! Common Stock.

During the quarter ended June 30, 1998, the Company recorded a non-recurring

charge of $15.0 million for in-process research and development that had not yet

reached technological feasibility and had no alternative future use. On October 20,

1998, the Company completed the acquisition of all outstanding shares, options, and

warrants of Yoyodyne through the issuance of 561,244 shares of Yahoo! Common

Stock and options and warrants to purchase Yahoo! Common Stock. During the

quarter ended December 31, 1998, the Company recorded a one-time charge of

approximately $2.1 million for expenses incurred with the transaction. During

December 1998, the Company completed the acquisition of all outstanding shares

of HyperParallel through the issuance of 74,856 shares of Yahoo! Common Stock

and some cash. During the quarter ended December 31, 1998, the Company recorded

a non-recurring charge of $2.3 million for in-process research and development

that had not yet reached technological feasibility and had no alternative future use.

During July 1997, the Company and VISA entered into an agreement under which

the Visa Group released the Company from certain obligations and claims. In

connection with this agreement, Yahoo! issued 2,797,924 shares of Yahoo! Common

Stock to the Visa Group, for which the Company recorded a one-time, non-cash,

pre-tax charge of $21.2 million in the second quarter ended June 30, 1997. In con-

junction with the October 1997 acquisition of Four11 Corporation, the Company

recorded a one-time charge of $3.9 million which consisted of investment banking

fees, legal and accounting fees, redundancy costs, and certain other expenses

directly related to the acquisition.

Investment Income, Net. Investment income, net of expense, was $14.6 million for

the year ended December 31, 1998 compared to $4.5 million and $4.0 million for

the years ended December 31, 1997 and 1996, respectively. The increase from 1997

to 1998 is primarily attributable to a higher average investment balance, princi-

pally due to proceeds of $250.0 million received by the Company on July 14, 1998 34 35

32

30

33

28

31

26

29

24

27

22

25

20

23

18

21

19

36 37

38 39