Yahoo 1998 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

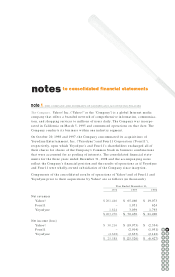

Stock Splits. During July 1998, the Company’s Board of Directors approved a two-

for-one Common Stock split. Shareholders of record on July 17, 1998 (the record

date) received one additional share for every share held on that date. The shares

were distributed on J uly 31, 1998 and the stock split was effective on August 3, 1998.

During January 1999, the Company’s Board of Directors approved a two-for-one

Common Stock split. Shareholders of record on J anuary 22, 1999 (the record date)

received one additional share for every share held on that date. The shares were

distributed on February 5, 1999 and the stock split was effective on February 8, 1999.

All share numbers in these consolidated financial statements and notes thereto

for all periods presented have been adjusted to reflect the two-for-one common

stock splits.

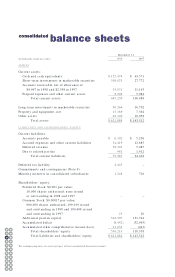

Principles of Consolidation. The consolidated financial statements include the

accounts of Yahoo! Inc. and its majority-owned subsidiaries. All significant inter-

company accounts and transactions have been eliminated. The equity and net loss

attributable to the minority shareholder interests that related to the Company’s

subsidiaries, are shown separately in the consolidated balance sheets and

consolidated statements of operations, respectively. Losses in excess of the minority

interest equity would be charged against the Company. Investments in entities

owned 20% or more but less than majority owned and not otherwise controlled by

the Company are accounted for under the equity method.

Reclassifications. Certain prior years’ balances have been reclassified to conform

with the current year’s presentation.

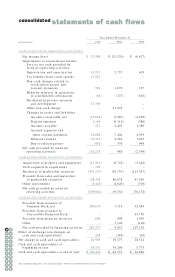

Revenue Recognition. The Company’s revenues are derived principally from the sale

of banner and sponsorship advertisements. The Company’s standard rates for banner

advertising currently range from approximately $6.00 per thousand impressions

for run of network to approximately $90.00 per thousand impressions for highly

targeted audiences and properties. To date, the duration of the Company’s banner

advertising commitments has ranged from one week to two years. Sponsorship

advertising contracts have longer terms (ranging from three months to two years)

than standard banner advertising contracts and also involve more integration with

Yahoo! services, such as the placement of buttons that provide users with direct

links to the advertiser’s Web site. Advertising revenues on both banner and

sponsorship contracts are recognized ratably over the period in which the adver-

tisement is displayed, provided that no significant Company obligations remain at

the end of a period and collection of the resulting receivable is probable. Company

obligations typically include guarantees of minimum number of “impressions,” or

times that an advertisement appears in pages viewed by users of the Company’s

online properties. To the extent minimum guaranteed impressions are not met, the

Company defers recognition of the corresponding revenues until the remaining

guaranteed impression levels are achieved.

The Company also earns revenue on sponsorship contracts from fees relating to the

design, coordination, and integration of customers’ content and links into Yahoo!

online media properties. These development fees are recognized as revenue once

the related activities have been performed and the customer’s Web links are avail-

able on Yahoo! online media properties. A number of the Company’s agreements

provide that Yahoo! receive revenues from electronic commerce transactions.

Currently, these revenues are recognized by the Company upon notification from

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62