Yahoo 1998 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

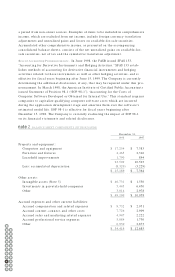

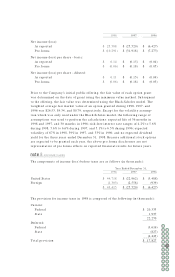

The following table summarizes information concerning outstanding and exercis-

able options at December 31, 1998 (in thousands, except per share amounts):

Options Outstanding Options Exercisable

Weighted Weighted Weighted

Average Average Average

Remaining Exercise Exercise

Range of Number Contractual Price Number Price

Exercise Prices Outstanding Life (in years) per Share Exercisable per Share

less than $0.01 8,002 6.6 $ 0.00 5,187 $ 0.00

$0.03 - $1.17 6,473 7.1 0.60 3,141 0.69

$1.25 - $3.21 5,940 7.6 2.57 1,765 2.53

$3.33 - $8.08 5,518 8.3 5.41 912 5.15

$10.78 - $13.47 7,711 8.9 12.96 1,766 13.09

$13.94 - $29.14 6,100 9.2 20.58 141 14.41

$30.38 - $57.75 6,481 9.6 47.12 – –

$62.41 - $135.00 6,624 9.9 95.89 – –

52,849 8.4 $ 22.99 12,912 $ 2.83

Options to purchase approximately 7.9 million shares and 3.3 million shares were

vested at December 31, 1997 and 1996, respectively. The weighted average exercise

prices per share for options vested at December 31, 1997 and 1996 were $0.99 and

less than $0.01, respectively. Through December 31, 1998, Yahoo! and certain

acquired entities recorded compensation expense related to certain stock options

issued with exercise prices below the fair market value of the related common stock.

The Company recorded compensation expense in the amount of $926,000, $1,215,000,

and $164,000 in 1998, 1997, and 1996, respectively. Approximately $1,017,000

remains to be amortized over the remaining vesting periods of the options.

Employee Stock Purchase Plan. Effective March 6, 1996, the Company’s Board of

Directors adopted the Employee Stock Purchase Plan (the “Purchase Plan”), which

provides for the issuance of a maximum of 1,800,000 shares of Common Stock.

Eligible employees can have up to 15% of their earnings withheld, up to certain

maximums, to be used to purchase shares of the Company’s Common Stock on

every December 31st and J une 30th. The price of the Common Stock purchased

under the Purchase Plan will be equal to 85% of the lower of the fair market value

of the Common Stock on the commencement date of each six-month offering period

or the specified purchase date. During 1998, 126,000 shares were purchased at

prices from $14.72 to $36.10 per share. During 1997, 537,000 shares were purchased

at prices from $1.85 to $4.83 per share. There were no shares issued under the

Purchase Plan during 1996. At December 31, 1998, 1,137,000 shares were available

under the Purchase Plan for future issuance.

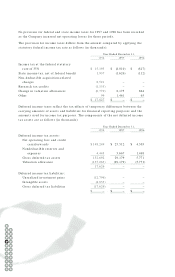

Stock Compensation. The Company accounts for stock-based compensation in accor-

dance with the provisions of APB 25. Had compensation expense been determined

based on the fair value at the grant dates, as prescribed in SFAS 123, the Company’s

results would have been as follows (in thousands, except per share amounts):

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62