Yahoo 1998 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

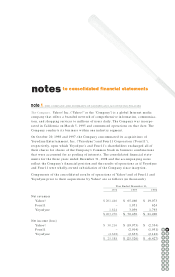

income or expense as incurred. As of December 31, 1998, the Company recorded net

unrealized gains, net of income taxes, of $21.8 million.

The Company invests in equity instruments of privately-held, information technol-

ogy companies for business and strategic purposes. These investments are included

in other long-term assets and are accounted for under the cost method when own-

ership is less than 20%. For these non-quoted investments, the Company’s policy is

to regularly review the assumptions underlying the operating performance and

cash flow forecasts in assessing the carrying values. The Company identifies and

records impairment losses on long-lived assets when events and circumstances

indicate that such assets might be impaired. To date, no such impairment has been

recorded. During 1998, certain of these investments in privately-held companies

became marketable equity securities when the investees completed initial public

offerings. Such investments, which are in the Internet industry, are subject to sig-

nificant fluctuations in fair market value due to the volatility of the stock market,

and are recorded as long-term investments.

Concentration of Credit Risk. Financial instruments that potentially subject the

Company to significant concentration of credit risk consist primarily of cash, cash

equivalents, short and long-term investments, and accounts receivable. Substan-

tially all of the Company’s cash, cash equivalents, and short and long-term invest-

ments are managed by four financial institutions. Accounts receivable are typically

unsecured and are derived from revenues earned from customers primarily located

in the United States. The Company performs ongoing credit evaluations of its cus-

tomers and maintains reserves for potential credit losses; historically, such losses

have been within management’s expectations. At December 31, 1998 and 1997, no

one customer accounted for 10% or more of the accounts receivable balance.

Depreciation and Amortization. Property and equipment, including leasehold

improvements, are stated at cost and depreciated using the straight-line method

over the estimated useful lives of the assets, generally two to five years. Goodwill

and other intangible assets are included in other assets and are carried at cost less

accumulated amortization, which is being provided on a straight-line basis over the

economic lives of the respective assets, generally three to seven years. The Company

periodically evaluates the recoverability of its long-lived assets based on expected

undiscounted cash flows and recognizes impairments, if any, based on expected

discounted future cash flows.

Income Taxes. Income taxes are computed using the asset and liability method.

Under the asset and liability method, deferred income tax assets and liabilities are

determined based on the differences between the financial reporting and tax bases

of assets and liabilities and are measured using the currently enacted tax rates and

laws. A valuation allowance is provided for the amount of deferred tax assets that,

based on available evidence, are not expected to be realized.

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62