Yahoo 1998 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Company’s financial position and the results of operations as if Yoyodyne was

a wholly-owned subsidiary of the Company since inception. During October 1998,

the Company recorded a one-time charge of $2.1 million for acquisition-related

costs. These costs consisted of broker fees, legal and accounting fees, and certain

other expenses directly related to the acquisition.

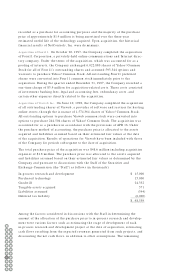

Acquisition of HyperParallel, Inc. On December 17, 1998, the Company completed

the acquisition of all outstanding shares of HyperParallel, Inc. (“HyperParallel”), a

direct marketing company specializing in data analysis, through the issuance of

74,856 shares of Yahoo! Common Stock and cash, totaling $8.1 million. The acquisi-

tion was accounted for as a purchase in accordance with APB 16. Under the purchase

method of accounting, the purchase price is allocated to the assets acquired and

liabilities assumed based on their estimated fair values at the date of the acquisi-

tion. The excess purchase price over the estimated fair value of the assets acquired

and liabilities assumed has been allocated to goodwill. Results of operations for

HyperParallel have been included with those of the Company for periods subse-

quent to the date of acquisition. The Company estimated that the economic useful

lives of current technology and goodwill were three and seven years, respectively.

The Company recorded a charge to earnings of $2.3 million for in-process research

and development that had not yet reached technological feasibility and had no

alternative future use. Factors considered in estimating the allocation of purchase

price to in-process research and development were estimating cash flows resulting

from the expected revenues to be generated from the project, and discounting the

net cash flows, in addition to other assumptions. If this project is not successfully

developed, the Company’s sales and profitability may be adversely affected in

future periods.

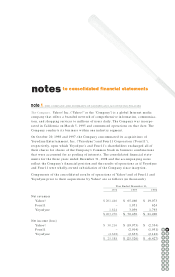

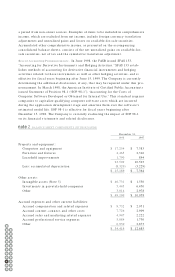

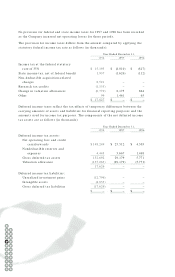

Unaudited Pro Forma Disclosures of Significant Acquisitions. The following unaudited

pro forma consolidated results of operations give effect to the acquisitions of

Viaweb and HyperParallel as if they occurred as of the beginning of the period

(in thousands, except per share data):

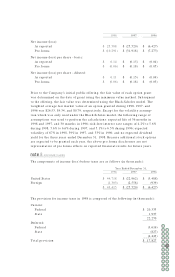

Year Ended December 31,

1998 1997

Net revenues $ 204,136 $ 71,392

Net income (loss) $ 22,290 $ (31,866)

Net income (loss) per share - basic $ 0.12 $ (0.18)

Net income (loss) per share - diluted $ 0.10 $ (0.18)

Shares used in per share calculation - basic 184,835 175,929

Shares used in per share calculation - diluted 224,983 175,929

J OINT VENTURES

Yahoo! Japan. During April 1996, the Company signed a joint venture agreement

with SOFTBANK whereby Yahoo! Japan Corporation was formed to establish and

manage in Japan a Japanese version of the Yahoo! Internet Guide, develop related

J apanese online navigational services, and conduct other related business. The

Company’s ownership interest in the joint venture upon inception was 40%. During

November 1997, Yahoo! J apan Corporation completed its initial public offering,

note 6

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62