Yahoo 1998 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

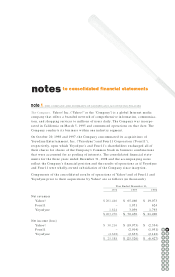

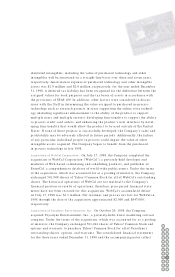

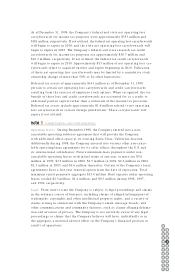

identified intangibles, including the value of purchased technology and other

intangibles will be amortized on a straight-line basis over three and seven years,

respectively. Amortization expense of purchased technology and other intangible

assets was $2.9 million and $2.0 million, respectively, for the year ended December

31, 1998. A deferred tax liability has been recognized for the difference between the

assigned values for book purposes and the tax bases of assets in accordance with

the provisions of SFAS 109. In addition, other factors were considered in discus-

sions with the Staff in determining the value assigned to purchased in-process

technology such as research projects in areas supporting the online store technol-

ogy (including significant enhancement to the ability of the product to support

multiple users and multiple servers), developing functionality to support the ability

to process credit card orders, and enhancing the product’s user interface by devel-

oping functionality that would allow the product to be used outside of the United

States. If none of these projects is successfully developed, the Company’s sales and

profitability may be adversely affected in future periods. Additionally, the failure

of any particular individual project in process could impair the value of other

intangible assets acquired. The Company began to benefit from the purchased

in process technology in late 1998.

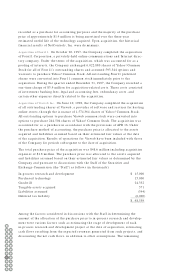

Acquisition of WebCal Corporation. On J uly 17, 1998, the Company completed the

acquisition of WebCal Corporation (“WebCal”), a privately-held developer and

marketer of Web-based calendaring and scheduling products, and publisher of

EventCal, a comprehensive database of world-wide public events. Under the terms

of the acquisition, which was accounted for as a pooling of interests, the Company

exchanged 541,908 shares of Yahoo! Common Stock for all of WebCal’s outstanding

shares. The historical operations of WebCal are not material to the Company’s

financial position or results of operations, therefore, prior period financial state-

ments have not been restated for this acquisition. WebCal’s accumulated deficit

on July 17, 1998 was $1.1 million. Net revenues and pre-tax net loss for WebCal in

1998 through the date of the acquisition approximated $2,000 and $847,000,

respectively.

Acquisition of Yoyodyne Entertainment, Inc. On October 20, 1998, the Company

acquired Yoyodyne Entertainment, Inc., a privately-held, direct marketing services

company. Under the terms of the acquisition, which was accounted for as a pooling

of interests, the Company exchanged 561,244 shares of Yahoo! Common Stock and

options and warrants to purchase Yahoo! Common Stock for all of Yoyodyne’s

outstanding shares, options, and warrants. The consolidated financial statements

for the three years ended December 31, 1998 and the accompanying notes reflect 56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62