Yahoo 1998 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

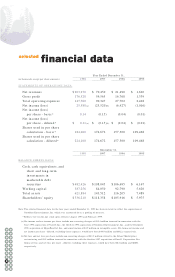

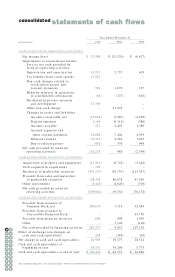

For the year ended December 31, 1998, cash provided by financing activities of

$281.3 million was due primarily to the issuance of Common Stock to SOFTBANK

in the amount of $250.0 million during July 1998 and the issuance of Common

Stock pursuant to the exercise of stock options. For the year ended December 31,

1997, cash provided by financing activities of $9.6 million was due primarily to

the issuance of Common Stock pursuant to the exercise of stock options. For the

year ended December 31, 1996, cash provided by financing activities of $107.2

million was primarily due to the March 1996 issuance of 5.1 million shares of

Convertible Series C Preferred Stock for aggregate proceeds of $63.8 million, the

April 1996 initial public offering of 17.9 million shares of Common Stock for net

proceeds of $35.1 million, and other issuances of Common Stock.

The Company currently has no material commitments other than those under

operating lease agreements. The Company has experienced a substantial increase

in its capital expenditures and operating lease arrangements since its inception,

which is consistent with increased staffing, and anticipates that this will con-

tinue in the future. Additionally, the Company will continue to evaluate possible

acquisitions of, or investments in businesses, products, and technologies that

are complementary to those of the Company, which may require the use of cash.

Management believes existing cash and investments will be sufficient to meet

the Company’s operating requirements for at least the next twelve months;

however, the Company may sell additional equity or debt securities or obtain

credit facilities to further enhance its liquidity position. The sale of additional

securities could result in additional dilution to the Company’s shareholders.

YEAR 2000 IMPLICATIONS

Many currently installed computer systems and software products are coded to

accept only two-digit entries in the date code field and cannot distinguish 21st

century dates from 20th century dates. These date code fields will need to

distinguish 21st century dates from 20th century dates and, as a result, many

companies’ software and computer systems may need to be upgraded or replaced

in order to comply with such “Year 2000” requirements. The Company is in the

process of assessing the Year 2000 issue and expects to complete the program by

the spring of 1999. The Company has not incurred material costs to date in this

process, and currently does not believe that the cost of additional actions will

have a material effect on its results of operations or financial condition.

Although Yahoo! currently believes that its systems are Year 2000 compliant in

all material respects, the current systems and products may contain undetected

errors or defects with Year 2000 date functions that may result in material costs.

Although Yahoo! is not aware of any material operational issues or costs associ-

ated with preparing its internal systems for the Year 2000, the Company may

experience serious unanticipated negative consequences (such as significant

downtime for one or more Yahoo! Media properties) or material costs caused by

undetected errors or defects in the technology used in its internal systems. In

addition, the Company utilizes third-party equipment, software and content,

including non-information technology systems (“non-IT systems”), such as its

security system, building equipment, and non-IT systems embedded microcon-

34 35

32

30

33

28

31

26

29

24

27

22

25

20

23

18

21

19

36 37

38 39