Yahoo 1998 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

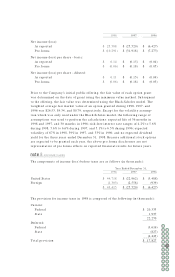

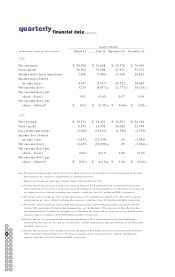

No provision for federal and state income taxes for 1997 and 1996 has been recorded

as the Company incurred net operating losses for these periods.

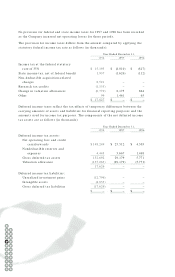

The provision for income taxes differs from the amount computed by applying the

statutory federal income tax rate as follows (in thousands):

Year Ended December 31,

1998 1997 1996

Income tax at the federal statutory

rate of 35% $ 15,195 $ (8,010) $ (817)

State income tax, net of federal benefit 1,937 (1,626) (112)

Non-deductible acquisition-related

charges 8,521 ––

Research tax credits (1,155) ––

Change in valuation allowances (6,770) 8,175 864

Other 99 1,461 65

$ 17,827 $–$–

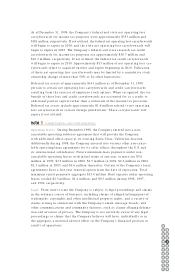

Deferred income taxes reflect the tax effects of temporary differences between the

carrying amounts of assets and liabilities for financial reporting purposes and the

amounts used for income tax purposes. The components of the net deferred income

tax assets are as follows (in thousands):

Year Ended December 31,

1998 1997 1996

Deferred income tax assets:

Net operating loss and credit

carryforwards $ 148,249 $ 25,512 $ 4,303

Nondeductible reserves and

expenses 4,443 3,667 1,468

Gross deferred tax assets 152,692 29,179 5,771

Valuation allowance (135,063) (29,179) (5,771)

17,629 ––

Deferred income tax liabilities:

Unrealized investment gains (12,796) ––

Intangible assets (4,833) ––

Gross deferred tax liabilities (17,629) ––

$–$–$–

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62