Yahoo 1998 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

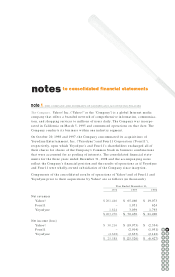

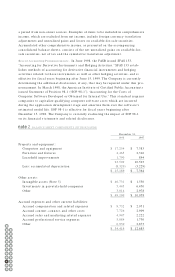

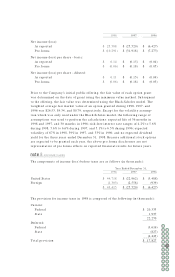

INVESTMENTS

At December 31, 1998, short and long-term investments in marketable securities

were classified as available-for-sale as follows (in thousands):

Gross Gross Gross Estimated

Amortized Unrealized Unrealized Fair

Costs Gains Losses Value

U.S. Government and agencies $ 331,757 $ 611 $ – $ 332,368

Municipal bonds 12,893 81 – 12,974

Corporate debt securities 8,584 26 – 8,610

Corporate equity securities 7,454 33,885 – 41,339

Other 3,020 – (20) 3,000

$ 363,708 $ 34,603 $ (20) $ 398,291

The contractual maturities of debt securities classified as available-for-sale as of

December 31, 1998 are as follows (in thousands):

Estimated

Fair Value

Due within one year $ 308,025

Due after one year through two years 48,927

$ 356,952

At December 31, 1997, short and long-term investments in marketable securities

were classified as available-for-sale and consisted of 81% corporate debt securities,

8% debt securities of the U.S. Government and its agencies, 4% municipal debt secu-

rities, and 7% foreign debt securities. At December 31, 1997, the fair value of the

investments approximated cost.

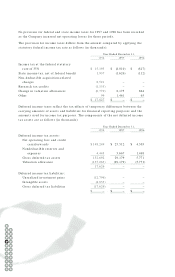

RELATED PARTY TRANSACTIONS

During 1998, 1997 and 1996, the Company recognized net revenues of approximately

$10.3 million, $3.1 million, and $2.4 million, respectively, on advertising contracts

and publication, development, and licensing arrangements with SOFTBANK and its

related companies (such as E*Trade Group, Inc., Kingston Technology Company,

and E-Loan, Inc.), a holder of approximately 30% of the Company’s Common Stock

at December 31, 1998. Prices on these contracts were comparable to those given to

other similar customers of the Company. Additionally, three SOFTBANK-related

companies provided Internet access and sales and marketing-related services for

fees of approximately $3.1 million, $3.2 million, and $2.3 million during 1998,

1997, and 1996, respectively. Sequoia Capital, a holder of approximately 3% of the

Company’s Common Stock at December 31, 1998, was also an investor in one of

these SOFTBANK-related companies.

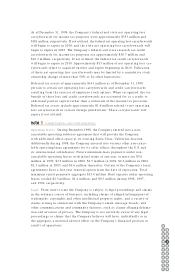

ACQUISITIONS

Acquisition of NetControls. On J uly 31, 1997, the Company entered into a stock

purchase agreement to acquire all of the outstanding capital stock of NetControls,

Inc. for 148,668 shares of the Company’s Common Stock. The acquisition was

note 3note 3

note 4note 4

note 5

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62