Yahoo 1998 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from a private placement of shares to SOFTBANK. Investment income in future

periods may fluctuate as a result of fluctuations in average cash balances main-

tained by the Company and changes in the market rates of its investments.

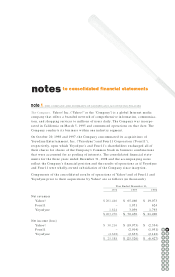

Minority Interests in Operations of Consolidated Subsidiaries. Minority interests in

operations of consolidated subsidiaries were $68,000 for the year ended December

31, 1998 compared to $727,000 and $540,000 for the years ended December 31, 1997

and 1996, respectively. The decrease from 1997 to 1998 is primarily attributable to

near break-even results in the European and Korean joint ventures in the aggre-

gate. The increase from 1996 to 1997 is primarily attributable to the staggered

launch dates of the joint ventures. Yahoo! Europe operations began during the

third quarter of 1996 and Yahoo! Korea operations started in the third quarter of

1997. The Company expects that minority interests in operations of consolidated

subsidiaries in the aggregate will continue to fluctuate in future periods as a

function of the results from consolidated subsidiaries. When, and if, the consoli-

dated subsidiaries become profitable, the minority interests adjustment on the

statement of operations will reduce the Company’s net income by the minority

partners’ share of the subsidiaries’ net income.

Income Taxes. Yahoo! recorded an income tax provision of $17.8 million in 1998. At

December 31, 1998, the Company had net operating loss carryforwards and research

tax credit carryforwards, which if not utilized, will begin to expire in 2003 through

2010. Deferred tax assets totaled $152.7 million of which approximately $141 mil-

lion relates to net operating loss carryforwards and tax credit carryforwards from

the exercise of stock options. When recognized, the tax benefit of the loss and credit

carryforwards is accounted for as a credit to additional paid-in capital rather than

as a reduction of income tax expense. The Company has a valuation allowance of

$135.1 million for deferred tax assets for which realization is not more-likely-than-

not. The Company’s 1998 estimated income tax rate was impacted during the year

by the release of the prior year’s valuation allowance, nondeductible acquisition-

related charges, and pre-acquisition losses of companies acquired in 1998.

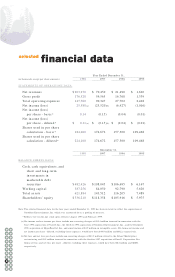

Net Income (Loss). The Company recorded net income of $25.6 million or $0.11

per share diluted for the year ended December 31,1998 compared to net losses of

$25.5 million and $6.4 million, or $0.15, and $0.04 per share diluted for the years

ended December 31, 1997 and 1996, respectively. Excluding the effect of the non-

recurring charge of $19.4 million incurred in connection with various 1998

acquisitions and the amortization of $2.9 million and $2.0 million from the

34 35

32

30

33

28

31

26

29

24

27

22

25

20

23

18

21

19

36 37

38 39