Yahoo 1998 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

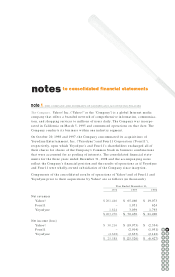

Stock-Based Compensation. The Company accounts for stock-based employee com-

pensation arrangements in accordance with the provisions of Accounting Principles

Board Opinion (“APB”) No. 25, “Accounting for Stock Issued to Employees,” and

complies with the disclosure provisions of Statement of Financial Accounting

Standards (“SFAS”) No. 123, “Accounting for Stock-Based Compensation.” Under APB

25, compensation cost is recognized over the vesting period based on the differ-

ence, if any, on the date of grant between the fair value of the Company’s stock and

the amount an employee must pay to acquire the stock.

Foreign Currency and International Operations. The functional currency of the

Company’s international subsidiaries is the local currency. The financial state-

ments of these subsidiaries are translated to United States dollars using year-end

rates of exchange for assets and liabilities, and average rates of exchange for

the year for revenues, costs, and expenses. Translation gains (losses), which are

deferred and accumulated as a component of shareholders’ equity, were $288,000,

($380,000), and ($63,000) for 1998, 1997, and 1996, respectively. Net gains and

losses resulting from foreign exchange transactions are included in the consoli-

dated statements of operations and were not significant during the periods presented.

International revenues have accounted for less than 10% of net revenues in the

years ended December 31, 1998, 1997, and 1996. International assets were not

significant at December 31, 1998, 1997, or 1996.

Basic and Diluted Net Income (Loss) per Share. Basic net income (loss) per share is

computed using the weighted average number of common shares outstanding dur-

ing the period. Diluted net income (loss) per share is computed using the weighted

average number of common and common equivalent shares outstanding during

the period. Common equivalent shares consist of the incremental common shares

issuable upon conversion of convertible preferred stock (using the if-converted

method) and shares issuable upon the exercise of stock options and warrants (using

the treasury stock method). For 1998, common equivalent shares primarily related

to shares issuable upon the exercise of stock options and approximated 40.0

million shares. Common equivalent shares in 1997 and 1996 were excluded from

the computation as their effect was anti-dilutive.

Use of Estimates. The preparation of financial statements in conformity with gener-

ally accepted accounting principles requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities, disclosure

of contingent assets and liabilities at the date of the financial statements, and the

reported amounts of revenues and expenses during the reported period. Actual

results could differ from those estimates.

Comprehensive Income. In June 1997, the Financial Accounting Standards Board

(“FASB”) issued SFAS 130, “Reporting Comprehensive Income,” which was adopted

by the Company in the first quarter of fiscal 1998. SFAS 130 establishes standards

for reporting comprehensive income and its components in a financial statement.

Comprehensive income as defined includes all changes in equity (net assets) during

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62