Yahoo 1998 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

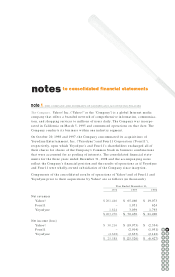

the advertiser of revenues earned by Yahoo!. Revenues from barter transactions are

recognized during the period in which the advertisements are displayed in Yahoo!

properties. Barter transactions are recorded at the fair value of the goods or services

provided or received, whichever is more readily determinable in the circumstances.

To date, revenues from development fees, electronic commerce transactions, and

barter transactions have each been less than 10% of net revenues.

No one customer accounted for 10% or more of net revenues during 1998 and 1997,

and SOFTBANK and its related companies (“SOFTBANK”), a holder of approximately

30% of the Company’s Common Stock at December 31, 1998, accounted for 11% of

net revenues during 1996 (see Note 4).

Deferred revenue is primarily comprised of billings in excess of recognized revenue

relating to advertising contracts and payments received pursuant to sponsorship

advertising contracts in advance of revenue recognition.

Product Development. Costs incurred in the classification and organization of listings

within Yahoo! properties and the development of new products and enhancements

to existing products are charged to expense as incurred. Material software develop-

ment costs subsequent to the establishment of technological feasibility are

capitalized. Based upon the Company’s product development process, technological

feasibility is established upon completion of a working model. Costs incurred by

the Company between completion of the working model and the point at which the

product is ready for general release have been insignificant.

Advertising Costs. Advertising production costs are recorded as expense the first

time an advertisement appears. All other advertising costs are expensed as

incurred. The Company does not incur any direct-response advertising costs.

Advertising expense totaled approximately $32.7 million, $10.9 million, and $4.2

million for 1998, 1997, and 1996, respectively.

Benefit Plan. The Company maintains a 401(k) Profit Sharing Plan (the “Plan”) for its

full-time employees. Each participant in the Plan may elect to contribute from 1% to

17% of his or her annual compensation to the Plan. The Company matches employee

contributions at a rate of 25%. Employee contributions are fully vested, whereas

vesting in matching Company contributions occurs at a rate of 33.3% per year of

employment. During 1998, 1997 and 1996, the Company’s contributions amounted

to $584,000, $263,000, and $81,000, respectively.

Cash and Cash Equivalents, Short and Long-Term Investments. The Company invests

its excess cash in debt instruments of the U.S. Government and its agencies, and in

high-quality corporate issuers. All highly liquid instruments with an original

maturity of three months or less are considered cash equivalents, those with original

maturities greater than three months and current maturities less than twelve

months from the balance sheet date are considered short-term investments, and

those with maturities greater than twelve months from the balance sheet date are

considered long-term investments.

The Company’s marketable securities are classified as available-for-sale as of the

balance sheet date and are reported at fair value, with unrealized gains and losses,

net of tax, recorded in shareholders’ equity. Realized gains or losses and permanent

declines in value, if any, on available-for-sale securities will be reported in other

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62