Yahoo 1998 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

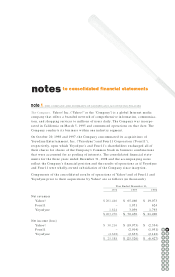

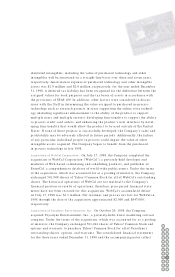

a period from non-owner sources. Examples of items to be included in comprehensive

income, which are excluded from net income, include foreign currency translation

adjustments and unrealized gains and losses on available-for-sale securities.

Accumulated other comprehensive income, as presented on the accompanying

consolidated balance sheets, consists of the net unrealized gains on available-for-

sale securities, net of tax and the cumulative translation adjustment.

Recent Accounting Pronouncements. In June 1998, the FASB issued SFAS 133,

“Accounting for Derivative Instruments and Hedging Activities.” SFAS 133 estab-

lishes methods of accounting for derivative financial instruments and hedging

activities related to those instruments as well as other hedging activities, and is

effective for fiscal years beginning after June 15, 1999. The Company is currently

determining the additional disclosures, if any, that may be required under this pro-

nouncement. In March 1998, the American Institute of Certified Public Accountants

issued Statement of Position 98-1 (“SOP 98-1”), “Accounting for the Costs of

Computer Software Developed or Obtained for Internal Use.” This standard requires

companies to capitalize qualifying computer software costs which are incurred

during the application development stage and amortize them over the software’s

estimated useful life. SOP 98-1 is effective for fiscal years beginning after

December 15, 1998. The Company is currently evaluating the impact of SOP 98-1

on its financial statements and related disclosures.

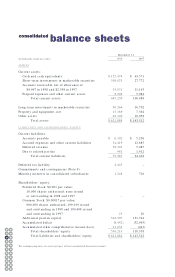

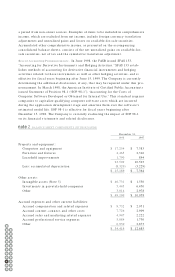

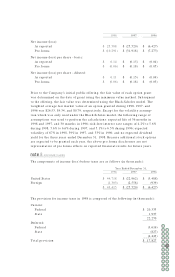

BALANCE SHEET COMPONENTS (IN THOUSANDS)

December 31,

1998 1997

Property and equipment:

Computers and equipment $ 17,254 $ 7,383

Furniture and fixtures 4,465 2,316

Leasehold improvements 1,790 894

23,509 10,593

Less: accumulated depreciation (8,320) (3,229)

$ 15,189 $ 7,364

Other assets:

Intangible assets (Note 5) $ 40,731 $ 1,530

Investments in privately-held companies 5,445 6,450

Other 3,014 2,978

$ 49,190 $ 10,958

Accrued expenses and other current liabilities:

Accrued compensation and related expenses $ 9,732 $ 2,951

Accrued content, connect, and other costs 7,726 2,909

Accrued sales and marketing related expenses 4,947 2,222

Accrued professional service expenses 5,084 1,730

Other 6,930 2,873

$ 34,419 $ 12,685

note 2

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62