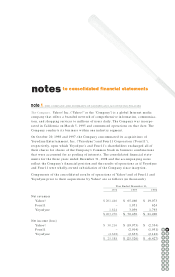

Yahoo 1998 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1998 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

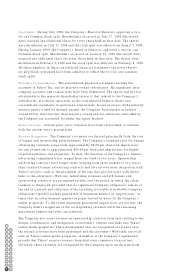

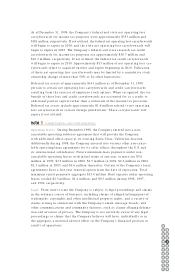

recorded as a purchase for accounting purposes and the majority of the purchase

price of approximately $1.4 million is being amortized over the three-year

estimated useful life of the technology acquired. Upon acquisition, the historical

financial results of NetControls, Inc. were de minimis.

Acquisition of Four11. On October 20, 1997, the Company completed the acquisition

of Four11 Corporation, a privately-held online communications and Internet direc-

tory company. Under the terms of the acquisition, which was accounted for as a

pooling of interests, the Company exchanged 6,022,880 shares of Yahoo! Common

Stock for all of Four11’s outstanding shares and assumed 593,344 options and

warrants to purchase Yahoo! Common Stock. All outstanding Four11 preferred

shares were converted into Four11 common stock immediately prior to the

acquisition. During the quarter ended December 31, 1997, the Company recorded a

one-time charge of $3.9 million for acquisition-related costs. These costs consisted

of investment banking fees, legal and accounting fees, redundancy costs, and

certain other expenses directly related to the acquisition.

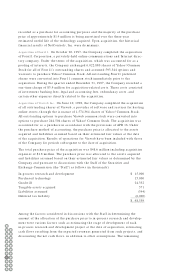

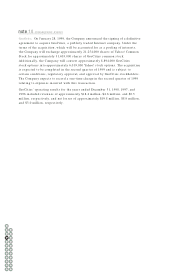

Acquisition of Viaweb Inc. On June 10, 1998, the Company completed the acquisition

of all outstanding shares of Viaweb, a provider of software and services for hosting

online stores, through the issuance of 1,574,364 shares of Yahoo! Common Stock.

All outstanding options to purchase Viaweb common stock were converted into

options to purchase 244,504 shares of Yahoo! Common Stock. The acquisition was

accounted for as a purchase in accordance with the provisions of APB 16. Under

the purchase method of accounting, the purchase price is allocated to the assets

acquired and liabilities assumed based on their estimated fair values at the date

of the acquisition. Results of operations for Viaweb have been included with those

of the Company for periods subsequent to the date of acquisition.

The total purchase price of the acquisition was $48.6 million including acquisition

expenses of $1.8 million. The purchase price was allocated to the assets acquired

and liabilities assumed based on their estimated fair values as determined by the

Company and pursuant to discussions with the Staff of the Securities and

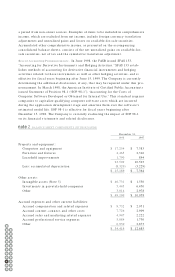

Exchange Commission (the “Staff”) as follows (in thousands):

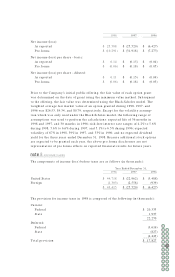

In-process research and development $ 15,000

Purchased technology 15,000

Goodwill 24,332

Tangible assets acquired 571

Liabilities assumed (344)

Deferred tax liability (6,000)

$ 48,559

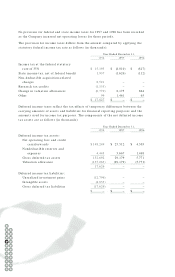

Among the factors considered in discussions with the Staff in determining the

amount of the allocation of the purchase price to in-process research and develop-

ment were various factors such as estimating the stage of development of each

in-process research and development project at the date of acquisition, estimating

cash flows resulting from the expected revenues generated from such projects, and

discounting the net cash flows, in addition to other assumptions. The remaining

56 57

54

52

55

50

53

48

51

46

49

44

47

42

45

40

43

41

58 59

60 61

62