Xcel Energy 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

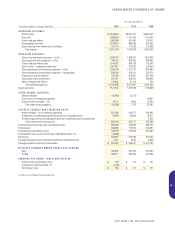

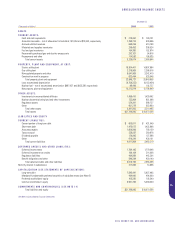

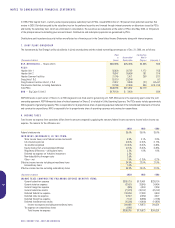

December 31

(Thousands of dollars) 2000 1999

LONG-TERM DEBT

NSP-MINNESOTA DEBT

First Mortgage Bonds, Series due:

Dec. 1, 2000–2006, 3.50–4.10% $ 13,230*$ 15,170*

Dec. 1, 2000, 5.75% 100,000

Oct. 1, 2001, 7.875% 150,000 150,000

March 1, 2003, 5.875% 100,000 100,000

April 1, 2003, 6.375% 80,000 80,000

Dec. 1, 2005, 6.125% 70,000 70,000

April 1, 2007, 6.80% 60,000**

March 1, 2011, variable rate, 5.05% at Dec. 31, 2000, and 5.75% at Dec. 31,1999 13,700** 13,700**

March 1, 2019, variable rate, 4.25% at Dec. 31, 2000, and 3.7% at Dec. 31,1999 27,900** 27,900**

Sept. 1, 2019, variable rate, 4.36% and 4.61% at Dec. 31, 2000, and 3.71% at Dec. 31, 1999 100,000** 100,000**

July 1, 2025, 7.125% 250,000 250,000

March 1, 2028, 6.5% 150,000 150,000

Guaranty Agreements, Series due: Feb. 1, 1999–May 1, 2003, 5.375–7.40% 29,950** 30,650**

NSP-Minnesota Senior Notes due Aug. 1, 2009, 6.875% 250,000 250,000

City of Becker Pollution Control Revenue Bonds – Series due Dec. 1, 2005, 7.25% 9,000**

City of Becker Pollution Control Revenue Bonds – Series due April 1, 2030, 5.1% at Dec. 31, 2000 69,000**

Anoka County Resource Recovery Bond – Series due Dec. 1, 2000–2008, 4.05–5.0% 17,990 19,615*

Employee Stock Ownership Plan Bank Loans due 2000–2007, variable rate 24,617 11,606

Other 194 1,458

Unamortized discount – net (5,513) (6,604)

Total 1,341,068 1,432,495

Less redeemable bonds classified as current (See Note 4) 141,600 141,600

Less current maturities 161,773 108,509

Total NSP-Minnesota long-term debt $1,037,695 $1,182,386

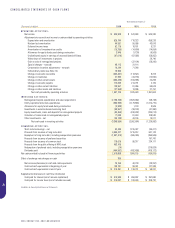

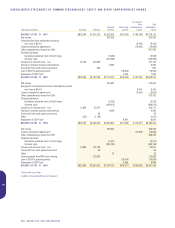

PSCO DEBT

First Mortgage Bonds, Series due:

Jan. 1, 2001, 6.00% $ 102,667 $ 102,667

April 15, 2003, 6.00% 250,000 250,000

March 1, 2004, 8.125% 100,000 100,000

Nov. 1, 2005, 6.375% 134,500 134,500

June 1, 2006, 7.125% 125,000 125,000

April 1, 2008, 5.625% 18,000** 18,000**

June 1, 2012, 5.5% 50,000** 50,000**

April 1, 2014, 5.875% 61,500** 61,500**

Jan. 1, 2019, 5.1% 48,750** 48,750**

July 1, 2020, 9.875% 70,000

March 1, 2022, 8.75% 147,840 148,000

Jan. 1, 2024, 7.25% 110,000 110,000

Unsecured Senior A Notes, due July 15, 2009, 6.875% 200,000 200,000

Secured Medium-Term Notes, due Feb. 1, 2001–March 5, 2007, 6.45–9.25% 226,500 256,500

Other secured long-term debt 13.25%, due in installments through Oct. 1, 2016 29,777 30,298

PSCCC Unsecured Medium-Term Notes due May 30, 2000, 5.86% 100,000

PSCCC Unsecured Medium-Term Notes due May 30, 2002, variable rate 7.40% at Dec. 31, 2000 100,000

Unamortized discount (5,952) (6,998)

Capital lease obligations, 11.2% due in installments through May 31, 2025 54,202 56,565

Total 1,752,784 1,854,782

Less current maturities 142,043 132,823

Total PSCo long-term debt $1,610,741 $1,721,959

*Resource recovery financing

**Pollution control financing

See Notes to Consolidated Financial Statements

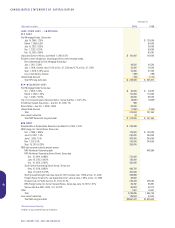

XCEL ENERGY INC. AND SUBSIDIARIES

37

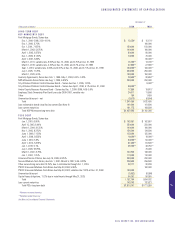

CONSOLIDATED STATEMENTS OF CAPITALIZATION