Xcel Energy 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

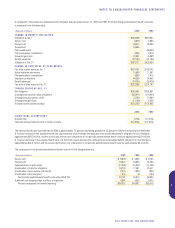

As of Dec. 31, 2000, Xcel Energy provided guarantees for EMI of approximately $27 million. Approximately $12 million of these guarantees related to energy

conservation projects in which EMI has guaranteed certain energy savings to the customer. As energy savings are realized each year due to these projects,

the value of the guarantee decreases until it reaches zero in 2017. Approximately $15 million of the guarantees relates to EMI’s line of credit with US Bank.

The Bank of New York has provided a letter of credit, at the request of Xcel Energy, of approximately $1.0 million to fulfill debt service reserve requirements

as support for a Young Gas Storage Co., Ltd. loan. Young Gas Storage entered into a $30.7-million credit agreement with various lending institutions in

March 1999 with a maturity of March 2014. The loan was incurred for the development and construction of an underground natural gas storage facility

in northeastern Colorado. Separately, Xcel Energy has guaranteed up to $4.5 million to cover costs of expenses related to the project.

NSP-Minnesota has sold a portion of its other receivables to a third party. The portion of the receivables sold consisted of customer loans to local and state

government entities for energy efficiency improvements under various conservation programs offered by NSP-Minnesota. Under the sales agreements, NSP-

Minnesota is required to guarantee repayment to the third party of the remaining loan balances. At Dec. 31, 2000, the outstanding balance of the loans was

approximately $18.1 million. Based on prior collection experience of these loans, NSP-Minnesota believes that losses under the loan guarantees, if any,

would have an immaterial impact on the results of operations.

In connection with an agreement for the sale of electric power, SPS guaranteed certain obligations of a customer totaling approximately $27.8 million at

Dec. 31, 2000. These obligations related to the construction of certain utility property that, in the event of default by the customer, would revert to SPS.

In June 2000, Xcel Energy entered into a guarantee on behalf of BNP Paribas in connection with a letter of credit provided by BNP Paribas at the request of

SPS in the amount of $5 million, expiring March 2002. The letter of credit is required to indemnify former SPS board of directors.

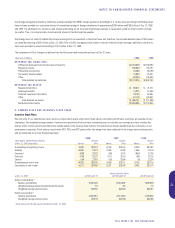

Derivatives

As of Dec. 31, 2000, NRG had four interest rate swap agreements with notional amounts totaling approximately $533 million. If the swaps had been

discontinued on Dec. 31, 2000, NRG would have owed the counterparties approximately $31 million. NRG believes that its exposure to credit risk due

to nonperformance by the counterparties to the hedging contracts is insignificant. These swaps are described below.

•A swap effectively converts a $16-million issue of non-recourse variable rate debt into fixed-rate debt. The swap expires in September 2002

and is secured by the Camas Power Boiler assets.

•A swap converts $178 million of non-recourse variable rate debt into fixed-rate debt. The swap expires in December 2014 and is secured by

the Crockett Cogeneration assets.

•A swap converts £188 million, the equivalent of $281 million, of non-recourse variable rate debt into fixed-rate debt. The swap expires in

June 2019 and is secured by the Killingholme assets.

•A swap converts variable rate debt to fixed rate debt. The notional amount is AUD 105 million, the equivalent of $59 million as of Dec. 31, 2000.

The swap expires in September 2012 and is secured by the Flinders Power assets.

SPS has an interest rate swap with a notional amount of $25 million, converting variable rate debt to a fixed-rate. Young Gas Storage and Quixx Linden

projects, which are unconsolidated equity investments of Xcel Energy, have interest rate swaps converting project debt from variable rate to fixed rate.

These two amortizing swaps had a total notional amount of $39.5 million on Dec. 31, 2000. The approximate termination cost of Xcel Energy’s portion of

these three swaps was $4.5 million at Dec. 31, 2000.

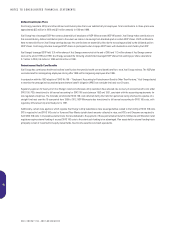

Xcel Energy’s regulated energy marketing operation uses a combination of energy futures and forward contracts, along with physical supply to hedge market

risks in the energy market. At Dec. 31, 2000, the notional value of these contracts was approximately $90.4 million. If these contracts had been terminated

on Dec. 31, 2000, Xcel Energy would have realized a net gain of approximately $18.7 million. Management believes the risk of counterparty nonperformance

with regards to any of the hedging transactions is not significant.

NRG’s Power Marketing subsidiary uses energy futures and forward contracts, along with physical supply, to hedge market risk in the energy market. At

Dec. 31, 2000, the net notional amount of these contracts was approximately $309.3 million. If the contracts had been terminated on Dec. 31, 2000, NRG

would have received approximately $52.8 million. Management believes the risk of counterparty nonperformance with regards to any of the hedging

transactions is not significant.

e prime uses various financial instruments as hedging mechanisms against future energy-related contractual obligations. e prime had financial derivatives

related to its retail business with a notional value of $8.3 million at Dec. 31, 2000. If these contracts had been terminated at Dec. 31, 2000, e prime would have

realized a net gain of $3.9 million. In addition, e prime’s wholesale portfolio had a net notional value of ($0.5) million, based on a combination of physical and

financial transactions. If these contracts had been terminated on Dec. 31, 2000, e prime would have received $3.3 million from the counterparties. Management

believes the risk of counterparty nonperformance with regards to any of the hedging transactions is not significant.

NRG had one foreign currency hedge outstanding at Dec. 31, 2000. The contract had a notional value of $8.8 million and hedged expected cash flows from the

Killingholme project in England. The currency hedge expired on Jan. 31, 2001. If the contract had been terminated on Dec. 31, 2000, NRG would have paid the

counterparties $0.7 million. Management believes the risk of counterparty nonperformance with regards to any of the hedging transactions is not significant.

XCEL ENERGY INC. AND SUBSIDIARIES

55

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS