Xcel Energy 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

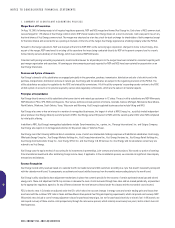

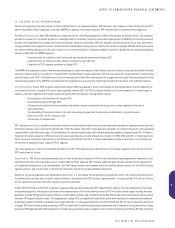

Regulatory Accounting

Xcel Energy’s regulated utility subsidiaries account for certain income and expense items using SFAS No. 71 – “Accounting for the Effects of Certain Types

of Regulation.” As discussed in Note 12 to the Financial Statements, SPS’ generation business no longer follows SFAS 71. Under SFAS 71:

•We defer certain costs, which would otherwise be charged to expense, as regulatory assets based on our expected ability to recover them

in future rates; and

•We defer certain credits, which would otherwise be reflected as income, as regulatory liabilities based on our expectation they will be

returned to customers in future rates.

We base our estimates of recovering deferred costs and returning deferred credits on specific rate-making decisions or precedent for each item. We amortize

regulatory assets and liabilities consistent with the period of expected regulatory treatment.

Stock-Based Employee Compensation

Xcel Energy has several stock-based compensation plans. We account for those plans using the intrinsic value method. We do not record compensation

expense for stock options because there is no difference between the market price and the purchase price at grant date. We do, however, record compensation

expense for restricted stock that we award to certain employees, but hold until the restrictions lapse or the stock is forfeited. We do not use the optional

accounting under SFAS No. 123 – “Accounting for Stock-Based Compensation.” If we had used the SFAS 123 method of accounting, earnings would have been

reduced by approximately 2 cents per share for 2000 and approximately 1 cent per share per year for 1999 and 1998.

NRG Development Costs

As NRG develops projects, it expenses the development costs it incurs until a sales agreement or letter of intent is signed and the project has received NRG

board approval. NRG capitalizes additional costs incurred at that point. When a project begins to operate, NRG amortizes the capitalized costs over either the

life of the project’s related assets or the revenue contract period, whichever is less. If a project is terminated without becoming operational, NRG expenses

the capitalized costs in the period of the termination.

Intangible Assets and Deferred Financing Costs

Goodwill results when Xcel Energy purchases an entity at a price higher than the underlying fair value of the net assets. We amortize the goodwill and

other intangible assets over periods consistent with the economic useful life of the assets. Our intangible assets are currently amortized over a range of

5 to 40 years. We periodically evaluate the recovery of goodwill based on an analysis of estimated undiscounted future cash flows. At Dec. 31, 2000,

Xcel Energy’s intangible assets included approximately $66 million of goodwill, net of $7 million of accumulated amortization.

Intangible and other assets also included deferred financing costs, net of amortization, of approximately $94 million at Dec. 31, 2000. We are amortizing

these financing costs over the remaining maturity periods of the related debt.

Reclassifications

We reclassified certain items in the 1998 and 1999 income statements and the 1999 balance sheet to conform to the 2000 presentation. These reclassifications

had no effect on net income or earnings per share. Reported amounts for periods prior to the merger have been restated to reflect the merger as if it had

occurred as of Jan. 1, 1998.

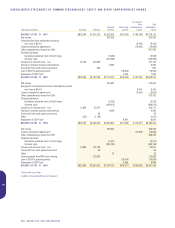

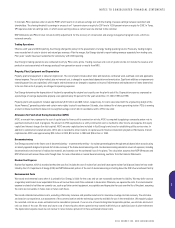

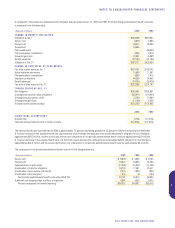

2. MERGER COSTS AND SPECIAL CHARGES

Special Charges 2000

Upon consummation of the merger in 2000, Xcel Energy expensed pretax special charges totaling $241 million. In the aggregate, these special charges

reduced Xcel Energy’s 2000 earnings by 52 cents per share. Of these pretax special charges, $201 million, or 43 cents per share, was recorded during

the third quarter of 2000, and $40 million, or 9 cents per share, was recorded during the fourth quarter of 2000.

The pretax charges included $52 million related to one-time transaction-related costs incurred in connection with the merger of NSP and NCE. These trans-

action costs include investment banker fees, legal and regulatory approval costs, and expenses for support of and assistance with planning and completing

the merger transaction.

Also included were $147 million of pretax charges pertaining to incremental costs of transition and integration activities associated with merging NSP and

NCE to begin operations as Xcel Energy. These transition costs include approximately $77 million for severance and related expenses associated with staff

reductions of 721 employees, 661 of whom were released through February 2001. The staff reductions were non-bargaining positions mainly in corporate and

operations support areas. Other transition and integration costs include amounts incurred for facility consolidation, systems integration, regulatory transition,

merger communications and operations integration assistance.

In addition, the pretax charges include $42 million of asset impairments and other costs resulting from the post-merger strategic alignment of Xcel Energy’s

nonregulated businesses. These special charges, which were recorded in the third quarter, include: $22 million of write-offs of goodwill and project devel-

opment costs for Planergy and Energy Masters International (EMI) energy services operations due to a change in their business focus and direction after

XCEL ENERGY INC. AND SUBSIDIARIES

43

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS