Xcel Energy 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

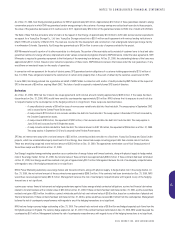

On or about July 12, 1999, Fortistar Capital, Inc. commenced an action against NRG in Hennepin County (Minnesota) District Court, seeking damages in

excess of $100 million and an order restraining NRG from consummating the acquisition of Niagara Mohawk Power Corp.’s Oswego generating station.

Fortistar’s motion for a temporary restraining order was denied. A temporary injunction hearing was held on Sept. 27, 1999. The acquisition was consummated

in October 1999. On Jan. 14, 2000, the court denied Fortistar’s request for a temporary injunction. In April and December 2000, NRG filed summary judgment

motions to dispose of the litigation respecting both liability and damages, and a hearing on these motions was held on Jan. 26, 2001. No ruling on the motions

has been received to date. A trial date has been scheduled for April 2001. NRG has asserted numerous counterclaims against Fortistar and will continue to

vigorously defend the suit.

NRG and other power generators and power traders have been named as defendants in certain private plaintiff class actions filed in the Superior Court of

the State of California for the County of San Diego in San Diego, California, on Nov. 27, 2000, and Nov. 29, 2000, and in the Superior Court of the State of

California, City and County of San Francisco filed Jan. 24, 2001. NRG and other power generators and power traders have also been named in another suit

filed on Jan. 16, 2001, in the Superior Court of the State of California for the County of San Diego, brought by three California water districts, as consumers

of electricity and in a suit filed on Jan. 18, 2001, in Superior Court of the State of California, County of San Francisco, brought by the San Francisco

City Attorney on behalf of the People of the State of California. Xcel Energy and Northern States Power Company were also named as defendants in the litigation

commenced in San Francisco because of their relationship with NRG. Although the complaints contain a number of allegations, the basic claim is that, by

underbidding forward contracts and exporting electricity to surrounding markets, the defendants, acting in collusion, were able to drive up wholesale

prices on the Real Time and Replacement Reserve markets, through the Western Systems Coordinating Council and otherwise. The complaints allege

that the conduct violated California antitrust and unfair competition laws. NRG does not believe that it has engaged in any illegal activities and intends to

vigorously defend these lawsuits.

On Feb. 3, 2000, Dynegy Engineering Inc. filed a lawsuit against Utility Engineering (UE), a wholly owned subsidiary of Xcel Energy, in Harris County, Texas. In

its lawsuit, Dynegy claims it is entitled to recover approximately $9.7 million for damages allegedly caused by UE’s late and deficient engineering services

performed for the Rocky Road electrical generating plant in Dundee, Ill. UE denies the merits of Dynegy’s lawsuit. UE also maintains that it is insured against

this claim pursuant to its professional liability policy. UE’s self-insured retention under this policy is $1 million.

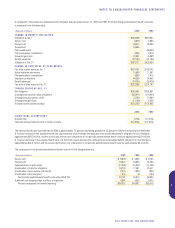

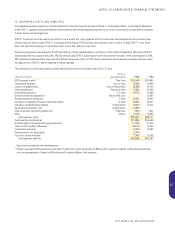

15. NUCLEAR OBLIGATIONS

Fuel Disposal

NSP-Minnesota is responsible for temporarily storing used or spent nuclear fuel from its nuclear plants. The DOE is responsible for permanently storing

spent fuel from NSP’s nuclear plants as well as from other U.S. nuclear plants. NSP-Minnesota has funded its portion of the DOE’s permanent disposal program

since 1981. The fuel disposal fees are based on a charge of 0.1 cent per kilowatt-hour sold to customers from nuclear generation. Fuel expense includes DOE

fuel disposal assessments of approximately $12 million in 2000, $12 million in 1999 and $11 million in 1998. In total, NSP-Minnesota had paid approximately

$284 million to the DOE through Dec. 31, 2000. However, we cannot determine whether the amount and method of the DOE’s assessments to all utilities will

be sufficient to fully fund the DOE’s permanent storage or disposal facility.

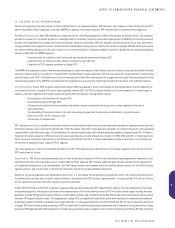

The Nuclear Waste Policy Act required the DOE to begin accepting spent nuclear fuel no later than Jan. 31, 1998. In 1996, the DOE notified commercial

spent fuel owners of an anticipated delay in accepting spent nuclear fuel by the required date and conceded that a permanent storage or disposal facility

will not be available until at least 2010. NSP-Minnesota and other utilities have commenced lawsuits against the DOE to recover damages caused by the

DOE’s failure to meet its statutory and contractual obligations.

NSP-Minnesota has its own temporary on-site storage facilities at its Monticello and Prairie Island nuclear plants. With the dry cask storage facilities

approved in 1994, management believes it has adequate storage capacity to continue operation of its Prairie Island nuclear plant until at least 2007. The

Monticello nuclear plant has storage capacity to continue operations until 2010. Storage availability to permit operation beyond these dates is not assured

at this time. We are investigating alternatives for spent fuel storage until a DOE facility is available, including pursuing the establishment of a private facility

for interim storage of spent nuclear fuel as part of a consortium of electric utilities. If on-site temporary storage at Prairie Island reaches approved capacity,

we could seek interim storage at this or another contracted private facility, if available.

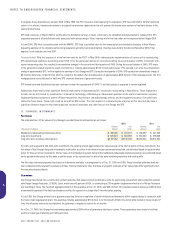

Nuclear fuel expense includes payments to the DOE for the decommissioning and decontamination of the DOE’s uranium enrichment facilities. In 1993,

NSP-Minnesota recorded the DOE’s initial assessment of $46 million, which is payable in annual installments from 1993–2008. NSP-Minnesota is amortizing

each installment to expense on a monthly basis. The most recent installment paid in 2000 was $4 million; future installments are subject to inflation

adjustments under DOE rules. NSP-Minnesota is obtaining rate recovery of these DOE assessments through the cost-of-energy adjustment clause as the

assessments are amortized. Accordingly, we deferred the unamortized assessment of $28 million at Dec. 31, 2000, as a regulatory asset.

XCEL ENERGY INC. AND SUBSIDIARIES

61

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS