Xcel Energy 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

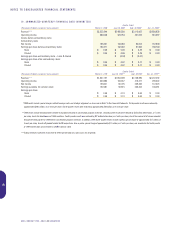

Site Remediation

We must pay all or a portion of the cost to remediate sites where past activities of our subsidiaries and some other parties have caused environmental

contamination. At Dec. 31, 2000, there were three categories of sites:

•Third-party sites, such as landfills, to which we are alleged to be a potentially responsible party (PRP) that sent hazardous materials and wastes;

•The site of a former federal uranium enrichment facility; and

•Sites of former manufactured gas plants (MGPs) operated by our subsidiaries or predecessors.

We record a liability when we have enough information to develop an estimate of the cost of remediating a site and revise the estimate as information is

received. The estimated remediation cost may vary materially.

To estimate the cost to remediate these sites, we may have to make assumptions where facts are not fully known. For instance, we might make assumptions about

the nature and extent of site contamination, the extent of required cleanup efforts, costs of alternative cleanup methods and pollution control technologies, the

period over which remediation will be performed and paid for, changes in environmental remediation and pollution control requirements, the potential effect of

technological improvements, the number and financial strength of other potentially responsible parties and the identification of new environmental cleanup sites.

We revise our estimates as facts become known, but at Dec. 31, 2000, our liability for the cost of remediating sites for which an estimate was possible was

$54 million, including $14 million in current liabilities.

Some of the cost of remediation may be recovered from others through:

•Insurance coverage;

•Recovery from other parties that have contributed to the contamination; and

•Recovery from customers.

Neither the total remediation cost nor the final method of cost allocation among all PRPs of the unremediated sites has been determined. We have recorded

estimates of our share of future costs for these sites. We are not aware of any other parties’ inability to pay, nor do we know if responsibility for any of the

sites is in dispute.

Federal Uranium Enrichment Facility

Approximately $23 million of the long-term liability and $4 million of the current liability relate to a DOE assessment to NSP-Minnesota and PSCo for

decommissioning a federal uranium enrichment facility. These environmental liabilities do not include accruals recorded and collected from customers in

rates for future nuclear fuel disposal costs or decommissioning costs related to NSP-Minnesota’s nuclear generating plants. See Note 15 to Financial Statements

for further discussion of nuclear obligations.

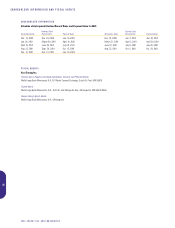

MGP Sites

NSP-Wisconsin was named as one of three PRPs for creosote and coal tar contamination at a site in Ashland, Wis. The Ashland site includes property owned

by NSP-Wisconsin and two other properties: an adjacent city, lakeshore park area and a small area of Lake Superior’s Chequemegon Bay adjoining the park.

The Wisconsin Department of Natural Resources (WDNR) and NSP-Wisconsin have each developed several estimates of the ultimate cost to remediate the

Ashland site. The estimates vary significantly, between $4 million and $93 million, because different methods of remediation and different results are assumed

in each. The EPA and WDNR are expected to select the method of remediation to use at the site during late 2001 or early 2002. Until the EPA and the WDNR

select a remediation strategy for all operable units at the site and determine the level of responsibility of each PRP, we are not able to accurately estimate our

share of the ultimate cost of remediating the Ashland site.

In the interim, NSP-Wisconsin has recorded a liability for an estimate of its share of the cost of remediating the portion of the Ashland site that it owns,

estimated using information available to date and using reasonably effective remedial methods. NSP-Wisconsin has deferred, as a regulatory asset, the

remediation costs accrued for the Ashland site because we expect that the Public Service Commission of Wisconsin (PSCW) will continue to allow

NSP-Wisconsin to recover payments for environmental remediation from its customers. The PSCW has consistently authorized recovery in NSP-Wisconsin

rates of all remediation costs incurred at the Ashland site, and has authorized recovery of similar remediation costs for other Wisconsin utilities.

We proposed, and the EPA and WDNR have approved, an interim action (a groundwater treatment system) for one operable unit at the site for which

NSP-Wisconsin has accepted responsibility. The groundwater treatment system began operating in the fall of 2000. NSP-Wisconsin continues to work

with the WDNR to access state and federal funds to apply to ultimate remediation cost of the entire site. It is probable that, even with outside funding,

final remedial costs to be borne by NSP-Wisconsin will be material.

The MPUC allowed NSP-Minnesota to defer certain remediation costs of four active remediation sites in 1994. In September 1998, the MPUC allowed the

recovery of these MGP site remediation costs in natural gas rates, with a portion assigned to NSP’s electric operations for two sites formerly used by NSP

generating facilities. Accordingly, NSP-Minnesota has recorded an environmental regulatory asset for these costs. NSP-Minnesota may request recovery

of costs to remediate other activated sites following the completion of preliminary investigations.

XCEL ENERGY INC. AND SUBSIDIARIES

59

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS