Xcel Energy 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

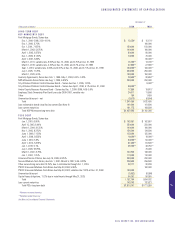

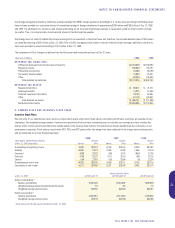

costs. SPS is the initial borrower under this credit agreement; however, at the time of separation of the generation assets, the obligations under this credit

agreement will be assumed by a newly formed generation company. See Note 12 to the Financial Statements for more information on restructuring.

In February 2001, SPS renewed a $300 million, 364-day revolving credit facility. This facility provides for direct borrowings, but its primary purpose is to

support the issuance of commercial paper.

In January 2001, NRG entered into a $600-million bridge credit facility to provide financing for its LS Power acquisition. It is expected to be repaid with the

proceeds of NRG’s planned common stock and equity unit offerings. The credit facility expires Dec. 31, 2001.

NRG has a $500-million revolving credit facility under a commitment fee arrangement that matures in March 2001. This facility provides short-term financing

in the form of bank loans. At Dec. 31, 2000, NRG had $8 million outstanding under this facility.

NRG has a $125-million syndicated letter of credit facility that matures in November 2003. At Dec. 31, 2000, NRG had $58 million outstanding under

this facility.

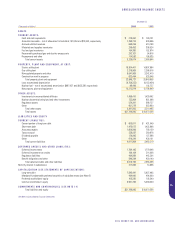

4. LONG-TERM DEBT

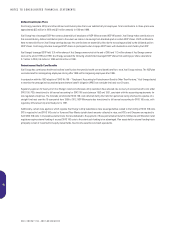

Except for SPS and other minor exclusions, all property of Xcel Energy’s utility subsidiaries is subject to the liens of its first mortgage indentures, which are

contracts between the companies and their bond holders. In addition, certain SPS payments under its pollution control obligations are pledged to secure

obligations of the Red River Authority of Texas.

The annual sinking-fund requirements of Xcel Energy’s utility subsidiaries’ first mortgage indentures are the amounts necessary to redeem 1 to 1.5 percent

of the highest principal amount of each series of first mortgage bonds at any time outstanding, excluding series issued for pollution control and resource

recovery financings and certain other series totaling $2 billion.

NSP-Minnesota, NSP-Wisconsin, PSCo and Cheyenne expect to satisfy substantially all of their sinking-fund obligations in accordance with the terms of

their respective indentures through the application of property additions. SPS has no significant sinking-fund requirements.

NSP-Minnesota’s 2011 and 2019 series first mortgage bonds have variable interest rates, which currently change at various periods up to 270 days,

based on prevailing rates for certain commercial paper securities or similar issues. The 2011 series bonds are redeemable upon seven-days notice at the

option of the bondholder. NSP-Minnesota also is potentially liable for repayment of the 2019 series when the bonds are tendered, which occurs each time

the variable interest rates change. The principal amount of all of these variable rate bonds outstanding represents potential short-term obligations and,

therefore, is reported under current liabilities on the balance sheets.

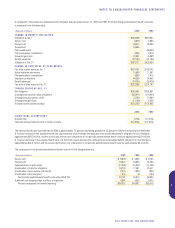

Maturities and sinking-fund requirements for Xcel Energy’s long-term debt are:

•2001 $605 million

•2002 $311 million

•2003 $663 million

•2004 $267 million

•2005 $286 million

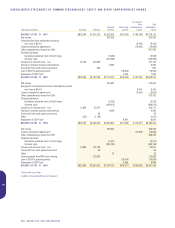

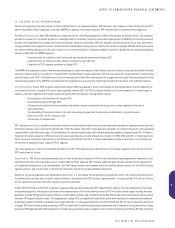

5. PREFERRED STOCK

At Dec. 31, 2000, Xcel Energy had various preferred stock series, which were callable at prices per share ranging from $102 to $103.75, plus accrued dividends.

PSCo has 10 million shares of cumulative preferred stock, $0.01 par value, authorized. At Dec. 31, 2000 and 1999, PSCo had no shares of preferred

stock outstanding.

SPS has 10 million shares of cumulative preferred stock, $1 par value, authorized. At Dec. 31, 2000 and 1999, SPS had no shares of preferred stock outstanding.

6. MANDATORILY REDEEMABLE PREFERRED SECURITIES OF SUBSIDIARY TRUSTS

In 1996, SPS Capital I, a wholly owned, special-purpose subsidiary trust of SPS, issued $100 million of 7.85 percent trust preferred securities that mature in

2036. Distributions paid by the subsidiary trust on the preferred securities are financed through interest payments on debentures issued by SPS and held by

the subsidiary trust, which are eliminated in consolidation. The securities are redeemable at the option of SPS after October 2001, at 100 percent of the

principal amount plus accrued interest. Distributions and redemption payments are guaranteed by SPS.

In 1997, NSP Financing I, a wholly owned, special-purpose subsidiary trust of NSP-Minnesota, issued $200 million of 7.875 percent trust preferred securities

that mature in 2037. Distributions paid by the subsidiary trust on the preferred securities are financed through interest payments on debentures issued by

NSP-Minnesota and held by the subsidiary trust, which are eliminated in consolidation. The preferred securities are redeemable at $25 per share beginning

in 2002. Distributions and redemption payments are guaranteed by NSP-Minnesota.

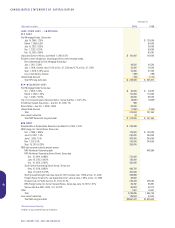

XCEL ENERGY INC. AND SUBSIDIARIES

45

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS