Xcel Energy 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

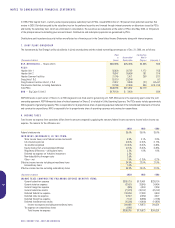

12. ELECTRIC UTILITY RESTRUCTURING

Restructuring legislation has been enacted in Texas and New Mexico, as summarized below. SPS has made, and continues to make, filings with the PUCT

and the New Mexico Public Regulation Commission (NMPRC) to address critical issues related to SPS transition plans to implement retail competition.

New Mexico Restructuring In April 1999, New Mexico enacted the Electric Utility Restructuring Act of 1999, which provides for customer choice. The legislation

provides for recovery of no less than 50 percent of stranded costs for all utilities. Transition costs must be approved by the NMPRC prior to being recovered

through a non-bypassable wires charge, which must be included in transition plan filings. SPS must separate its utility operations into at least two entities:

energy generation and competitive services, and transmission and distribution utility services, either by the creation of separate affiliates that may be owned

by a common holding company or by the sale of assets to one or more third parties. A regulated company, in general, is prohibited from providing unregulated

services. In May 2000, the NMPRC approved:

•Customer choice for residential, small commercial and educational customers by January 2002;

•Customer choice for commercial and industrial customers by July 2002; and

•Completion of SPS corporate separation by August 2001.

The NMPRC has reopened its electric restructuring rulemakings to consider the impacts on New Mexico electricity markets arising from the volatile California

electricity market conditions. In addition, in February 2001, the New Mexico Senate approved a bill that would delay the implementation of restructuring

and retail choice until 2007. The House has yet to act on the proposal to delay. We cannot predict the changes that may result from reconsideration of the

restructuring legislation or the NMPRC’s reconsideration of its regulations as a result of the continuing and significant conditions in the California markets.

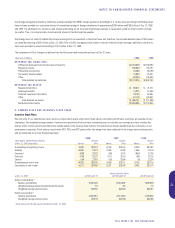

Texas Restructuring In June 1999, an electric utility restructuring act (SB-7) was passed in Texas, which provides for the implementation of retail competition for

most areas of the state, including SPS’ service area, beginning January 2002. The PUCT can delay the date for full retail competition if a power region is

unable to offer fair competition and reliable service during the 2001 pilot projects. The legislation requires:

•A rate freeze for all customers until January 2002;

•An annual earnings test through 2001;

•A 6-percent rate reduction for those residential and small commercial customers who choose not to switch suppliers at the start of

retail competition;

•The unbundling of business activities, costs and rates relating to generation, transmission and distribution, and retail services;

•Reductions in NOxand SO2emissions; and

•The recovery of stranded costs.

SB-7 requires each utility to unbundle its business activities into three separate legal entities: a power generation company, a regulated transmission and

distribution company, and a retail electric provider. SB-7 limits the market share that a single generation provider can control to 20 percent of the generating

capacity within a qualified power region. The establishment of a qualified power region with multiple generation suppliers is required under SB-7 in order to

implement full retail competition. SPS must return any excess earnings above its last allowed rate of return for 1999, 2000 and 2001, or alternatively may

direct any excess earnings to improvements in transmission and distribution facilities, to capital expenditures to improve air quality or to accelerate the

amortization of regulatory assets, subject to PUCT approval.

The Texas legislature is currently considering amendments to SB-7 that would delay the implementation of business separation and customer choice in

SPS’ market area for 5 years.

Implementation SPS filed its business separation plan in Texas during the first quarter of 2000 for the unbundling of power generation, transmission, and

distribution and retail electric provider services. In April 2000, the PUCT approved SPS’ business separation plan. The plan provides for the separation of

all competitive energy services, the establishment of an Xcel Energy customer care company, which will provide customer services for all of Xcel Energy’s

operating utilities, and a formal code of conduct and compliance manual for managing affiliate transactions.

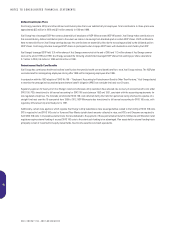

Subject to all required approvals and indebtedness restrictions, it is anticipated that all generation-related and certain other assets and liabilities will

be transferred at net book value to newly formed affiliates in accordance with SPS’ business separation plan. It is expected that SPS and its affiliates

will be capitalized consistent with their respective business operations.

In April 2000, SPS filed with the PUCT a stipulation agreement that specifically addresses SPS’ implementation plans to meet the requirements of the Texas

restructuring legislation. The stipulation provides for the implementation of full retail customer choice by SPS in its Texas service region, including the future

divestiture of certain SPS generation assets. Subject to certain market conditions and confirmation by the SEC that the sale would not violate pooling accounting

treatment, SPS agreed to divest at least 1,750 megawatts by January 2002, and specifically identified the plants that it would sell in connection with additional

divestitures required to establish a qualified power region under SB-7. In subsequent discussions, the SEC has indicated that the sale of generation assets prior

to August 2002 would violate pooling accounting. For SPS to comply with this qualified power region requirement and to implement full customer choice in Texas,

between 2,843 megawatts and 3,184 megawatts of existing power generation assets or capacity must be sold to third-party non-affiliates. SPS has committed

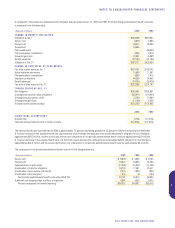

XCEL ENERGY INC. AND SUBSIDIARIES

53

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS