Xcel Energy 2000 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

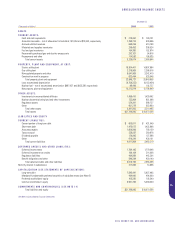

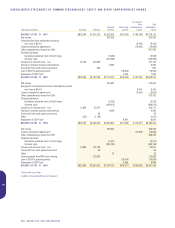

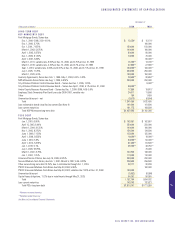

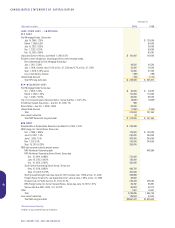

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY INC. AND SUBSIDIARIES

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

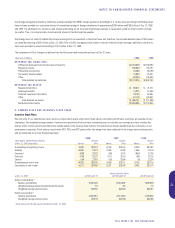

Merger Basis of Presentation

On Aug. 18, 2000, following receipt of all required regulatory approvals, NSP and NCE merged and formed Xcel Energy Inc. Each share of NCE common stock

was exchanged for 1.55 shares of Xcel Energy common stock. NSP shares became Xcel Energy shares on a one-for-one basis. Cash was paid in lieu of any

fractional shares of Xcel Energy common stock. The merger was structured as a tax-free, stock-for-stock exchange for shareholders of both companies (except

for fractional shares) and accounted for as a pooling-of-interests. At the time of the merger, Xcel Energy registered as a holding company under the PUHCA.

Pursuant to the merger agreement, NCE was merged with and into NSP. NSP, as the surviving legal corporation, changed its name to Xcel Energy. Also,

as part of the merger, NSP transferred its existing utility operations that were being conducted directly by NSP at the parent company level to a newly

formed wholly owned subsidiary of Xcel Energy, which was renamed NSP-Minnesota.

Consistent with pooling accounting requirements, results and disclosures for all periods prior to the merger have been restated for consistent reporting with

post-merger organization and operations. All earnings per share amounts previously reported for NSP and NCE have been restated for presentation on an

Xcel Energy share basis.

Business and System of Accounts

Xcel Energy’s domestic utility subsidiaries are engaged principally in the generation, purchase, transmission, distribution and sale of electricity and in the

purchase, transportation, distribution and sale of natural gas. Xcel Energy and its subsidiaries are subject to the regulatory provisions of the PUHCA. The

utility subsidiaries are subject to regulation by the FERC and state utility commissions. All of the utility companies’ accounting records conform to the FERC

uniform system of accounts or to systems required by various state regulatory commissions, which are the same in all material aspects.

Principles of Consolidation

Xcel Energy directly owns six utility subsidiaries that serve electric and natural gas customers in 12 states. These six utility subsidiaries are NSP-Minnesota,

NSP-Wisconsin, PSCo, SPS, BMG and Cheyenne. Their service territories include portions of Arizona, Colorado, Kansas, Michigan, Minnesota, New Mexico,

North Dakota, Oklahoma, South Dakota, Texas, Wisconsin and Wyoming. Xcel Energy’s regulated businesses also include Viking and WGI.

Xcel Energy also owns or has an interest in a number of nonregulated businesses, the largest of which is NRG Energy, Inc., a publicly traded independent

power producer. Xcel Energy indirectly owns 82 percent of NRG. Xcel Energy owned 100 percent of NRG until the second quarter 2000, when NRG completed

its initial public offering.

In addition to NRG, Xcel Energy’s nonregulated subsidiaries include Seren Innovations, Inc., e prime, inc., Planergy International, Inc. and Eloigne Company.

Xcel Energy also reports in its nonregulated activities its 50-percent stake in Yorkshire Power.

Xcel Energy owns the following additional direct subsidiaries, some of which are intermediate holding companies with additional subsidiaries: Xcel Energy

Wholesale Energy Group Inc., Xcel Energy Markets Holdings Inc., Xcel Energy International Inc., Xcel Energy Ventures Inc., Xcel Energy Retail Holdings Inc.,

Xcel Energy Communications Group Inc., Xcel Energy WYCO Inc. and Xcel Energy O & M Services Inc. Xcel Energy and its subsidiaries collectively are

referred to as Xcel Energy.

Xcel Energy uses the equity method of accounting for its investments in partnerships, joint ventures and certain projects. We record our portion of earnings

from international investments after subtracting foreign income taxes, if applicable. In the consolidation process, we eliminate all significant intercompany

transactions and balances.

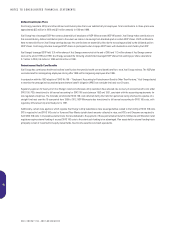

Revenue Recognition

Xcel Energy records utility revenues based on a calendar month, but reads meters and bills customers according to a cycle that doesn’t necessarily correspond

with the calendar month’s end. To compensate, we estimate and record unbilled revenues from the monthly meter-reading dates to the month’s end.

Xcel Energy’s utility subsidiaries have adjustment mechanisms in place that currently provide for the recovery of certain purchased natural gas and electric

energy costs. These cost adjustment tariffs may increase or decrease the level of costs recovered through base rates and are revised periodically, as prescribed

by the appropriate regulatory agencies, for any difference between the total amount collected under the clauses and the recoverable costs incurred.

PSCo’s electric rates in Colorado are adjusted under the ICA, which takes into account changes in energy costs and certain trading gains and losses that

are shared with the customer. SPS’ rates in Texas and New Mexico have periodic fuel filing and reporting requirements, which can provide cost recovery. NSP-

Wisconsin’s rates include a cost-of-energy adjustment clause for purchased natural gas, but not for purchased electricity or electric fuel. In Wisconsin, we

can request recovery of those electric costs prospectively through the rate review process, which normally occurs every two years, and an interim fuel cost

hearing process.

40