Xcel Energy 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

the merger; $10 million of contractual obligations and other costs associated with post-merger changes in the strategic operations and related revaluations

of e prime’s energy marketing business; and $10 million in asset write-downs and losses resulting from various other nonregulated business ventures

that would not be pursued after the merger. The write-downs were based on fair value estimates, consisting mainly of future cash flow projections.

The pretax special charges recognized for merger transaction, transition and integration activities include approximately $66 million in costs incurred prior

to third quarter 2000, which had been deferred prior to merger consummation. Consistent with pooling accounting requirements, upon consummation of

the merger to form Xcel Energy in the third quarter of 2000, Xcel Energy expensed all merger-related costs incurred up to that point.

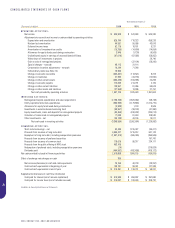

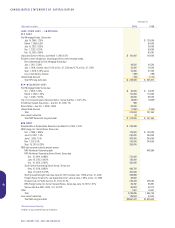

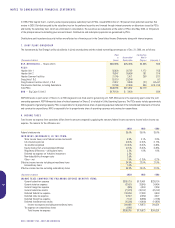

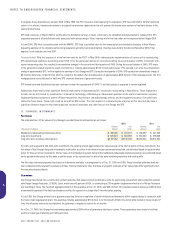

The following table summarizes the special charges expensed during 2000.

Expensed Without Accrual Expense Accrued as Liability Payments Against Liability Dec. 31, 2000

(Millions of dollars) 3rd Qtr. 4th Qtr. 3rd Qtr. 4th Qtr. 3rd Qtr. 4th Qtr. Liability*

Employee separation and other related costs $ 16 $ 3 $52 $6 $(10) $48

Regulatory transition costs 4 2 5 1 (1) 5

Other transition and integration costs 33 23 2 2

Total merger transition and integration costs 53 28 57 9 (11) 55

Transaction-related merger costs 49 3

Nonregulated asset disposals and abandonments 22

Nonregulated goodwill impairment 20

Total nonregulated asset impairments 42

Total special charges $144 $31 $57 $9 $(11) $55

*Reported on the balance sheet in other current liabilities.

Special Charges 1999

EMI Goodwill In December 1999, Xcel Energy recorded a pretax charge (reported in special charges) of approximately $17 million, or 4 cents per share, to

write off all goodwill that was recorded by its subsidiary EMI for its acquisitions of Energy Masters Corp. in 1995 and Energy Solutions International in 1997.

This charge reflected a revised business outlook based on the levels of contract signings by EMI.

Loss on Marketable Securities During 1999, Xcel Energy recorded pretax charges (reported in special charges) of approximately $14 million, or 3 cents per share,

for valuation write-downs on its investment in the publicly traded common stock of CellNet Data Systems, Inc. In October 1999, CellNet announced it was

experiencing financial difficulties and was contemplating restructuring its capital financing. In February 2000, CellNet filed for Chapter 11 bankruptcy protection.

CellNet’s assets were subsequently acquired by another company.

3. SHORT-TERM BORROWINGS

Notes Payable and Commercial Paper

Information regarding notes payable and commercial paper for the years ended Dec. 31, 2000 and 1999, is:

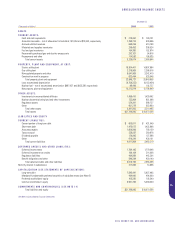

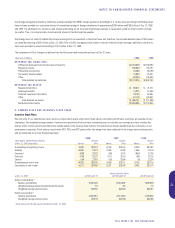

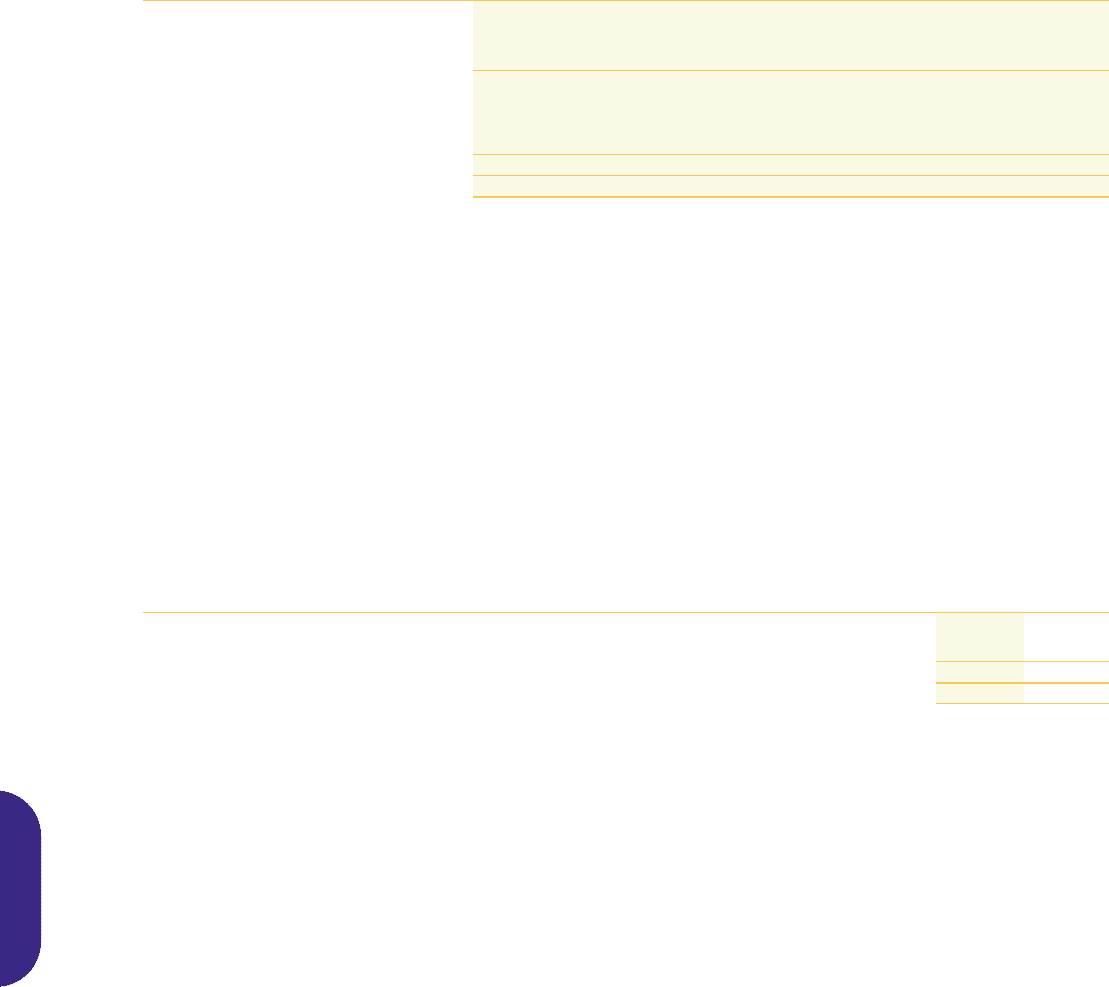

(Millions of dollars, except interest rates) 2000 1999

Notes payable to banks $ 20 $ 399

Commercial paper 1,455 1,034

Total short-term debt $1,475 $1,433

Weighted average interest rate at year end 6.48% 6.37%

Bank Lines of Credit and Compensating Bank Balances

At Dec. 31, 2000, Xcel Energy and its subsidiaries had approximately $3.0 billion in unsecured revolving credit facilities with several banks. Arrangements by

Xcel Energy and its subsidiaries for committed lines of credit are maintained by a combination of fee payments and compensating balances.

In November 2000, Xcel Energy closed on two revolving credit facilities totaling $800 million. These facilities are comprised of a $400 million, 364-day

maturity and a $400 million, five-year maturity. They are available for Xcel’s general corporate purposes, primarily supporting commercial paper borrowings.

In July 2000, NSP-Minnesota closed on a $300 million, 364-day revolving credit facility. This facility provides short-term financing in the form of bank loans

and letters of credit, but its primary purpose is support for commercial paper borrowings.

In July 2000, PSCo and its subsidiary, Public Service of Colorado Credit Corporation (PSCCC), entered into a $600 million, 364-day revolving credit agreement

that provides for direct borrowings, but whose primary purpose is to support the issuance of commercial paper by PSCo and PSCCC.

In July 2000, SPS entered into a $500-million credit agreement that is effective through January 2002. This credit facility was initially used as support for the

issuance of commercial paper to fund open market purchases, tender and defeasance of SPS’ outstanding first mortgage bonds and other related restructuring

44