Xcel Energy 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

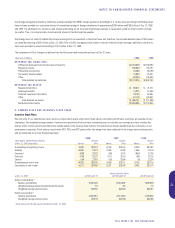

Defined Contribution Plans

Xcel Energy maintains 401(k) and other defined contribution plans that cover substantially all employees. Total contributions to these plans were

approximately $23 million in 2000 and $21 million annually in 1999 and 1998.

Xcel Energy has a leveraged ESOP that covers substantially all employees of NSP-Minnesota and NSP-Wisconsin. Xcel Energy makes contributions to

this noncontributory, defined contribution plan to the extent we realize a tax savings from dividends paid on certain ESOP shares. ESOP contributions

have no material effect on Xcel Energy earnings because the contributions are essentially offset by the tax savings provided by the dividends paid on

ESOP shares. Xcel Energy allocates leveraged ESOP shares to participants when it repays ESOP loans with dividends on stock held by the ESOP.

Xcel Energy’s leveraged ESOP held 12.0 million shares of Xcel Energy common stock at the end of 2000 and 11.3 million shares of Xcel Energy common

stock at the end of 1999 and 1998. Xcel Energy excluded the following uncommitted leveraged ESOP shares from earnings per share calculations:

0.7 million in 2000, 0.5 million in 1999 and 0.6 million in 1998.

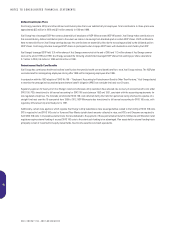

Postretirement Health Care Benefits

Xcel Energy has contributory health and welfare benefit plans that provide health care and death benefits to most Xcel Energy retirees. The NSP plan

was terminated for nonbargaining employees retiring after 1998 and for bargaining employees after 1999.

In conjunction with the 1993 adoption of SFAS No.106 – “Employers’ Accounting for Postretirement Benefits Other Than Pensions,” Xcel Energy elected

to amortize the unrecognized accumulated postretirement benefit obligation (APBO) on a straight-line basis over 20 years.

Regulatory agencies for nearly all of Xcel Energy’s retail and wholesale utility customers have allowed rate recovery of accrued benefit costs under

SFAS 106. PSCo transitioned to full accrual accounting for SFAS 106 costs between 1993 and 1997, consistent with the accounting requirements for

rate regulated enterprises. The Colorado jurisdictional SFAS 106 costs deferred during the transition period are being amortized to expense on a

straight-line basis over the 15-year period from 1998 to 2012. NSP-Minnesota also transitioned to full accrual accounting for SFAS 106 costs, with

regulatory differences fully amortized prior to 1997.

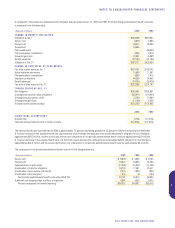

Additionally, certain state agencies, which regulate Xcel Energy’s utility subsidiaries, have issued guidelines related to the funding of SFAS 106 costs.

SPS is required to fund SFAS 106 costs for Texas and New Mexico jurisdictional amounts collected in rates, and PSCo and Cheyenne are required to

fund SFAS 106 costs in irrevocable external trusts that are dedicated to the payment of these postretirement benefits. Minnesota and Wisconsin retail

regulators require external funding of accrued SFAS 106 costs to the extent such funding is tax advantaged. Plan assets held in external funding trusts

principally consist of investments in equity mutual funds, fixed income securities and cash equivalents.

50

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS