Xcel Energy 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

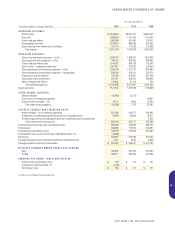

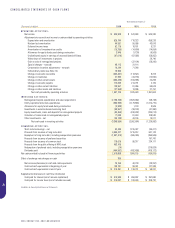

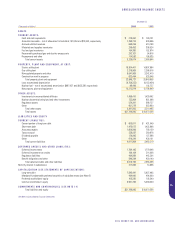

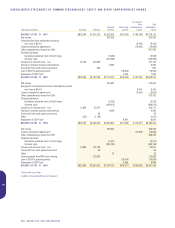

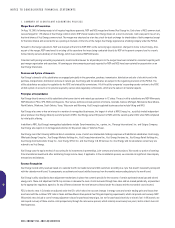

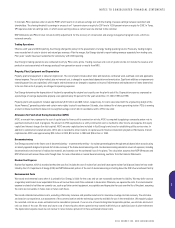

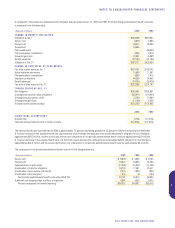

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Income Taxes

Xcel Energy and its subsidiaries file consolidated federal and combined and separate state income tax returns. Income taxes for consolidated or combined

subsidiaries are allocated to the subsidiaries based on separate company computations of taxable income or loss. Xcel Energy defers income taxes for all

temporary differences between pretax financial and taxable income, and between the book and tax bases of assets and liabilities. We use the tax rates that

are scheduled to be in effect when the temporary differences are expected to turn around, or reverse.

Due to the effects of past regulatory practices, when deferred taxes were not required to be recorded, we account for the reversal of some temporary differences

as current income tax expense. We defer investment tax credits and spread their benefits over the estimated lives of the related property. Utility rate regulation

also has created certain regulatory assets and liabilities related to income taxes, which we summarize in Note 16 to the Financial Statements. We discuss

our income tax policy for international operations in Note 8 to the Financial Statements.

Foreign Currency Translation

Xcel Energy’s foreign operations generally use the local currency as their functional currency in translating international operating results and balances to

U.S. currency. Foreign currency denominated assets and liabilities are translated at the exchange rates in effect at the end of a reporting period. Income,

expense and cash flows are translated at weighted-average exchange rates for the period. We accumulate the resulting currency translation adjustments

and report them as a component of Other Comprehensive Income. When we convert cash distributions made in one currency to another currency, we include

those gains and losses in the results of operations as a component of other income.

Derivative Financial Instruments

Xcel Energy and its subsidiaries utilize a variety of derivatives, including interest rate swaps and locks, foreign currency hedges and energy contracts. The

energy contracts are both financial- and commodity-based, in the energy trading and energy non-trading operations, to reduce exposure to commodity price

risk. These contracts consist mainly of commodity futures and options, index or fixed price swaps and basis swaps.

Xcel Energy and its subsidiaries adopted Emerging Issues Task Force (EITF) 98-10, “Accounting for Energy Trading and Risk Management Activities,” effective

Jan. 1, 1999. EITF 98-10 requires gains or losses resulting from market value changes on energy trading contracts to be recorded in earnings. The initial

adoption of EITF 98-10 had an immaterial impact on Xcel Energy’s net income.

Energy contracts also are utilized by Xcel Energy and its subsidiaries in non-trading operations to reduce commodity price risk. Hedge accounting is applied

only if the contract reduces the price risk of the underlying hedged item and is designated as a hedge at its inception. Gains and losses related to qualifying

hedges of firm commitments or anticipated transactions are deferred and recognized as a component of purchased power or cost of gas sold when settlement

occurs. If, subsequent to the inception of the hedge, the underlying transactions are no longer likely to occur, the related gains and losses are recognized

currently in income.

While NRG is not currently hedging investments involving foreign currency, NRG will hedge such investments when it believes that preserving the U.S. dollar

value of the investment is appropriate. NRG is not hedging currency translation adjustments related to future operating results. NRG does not speculate in

foreign currencies. Xcel Energy is not currently hedging its foreign currency exposure associated with its investment in Yorkshire Power.

From time to time, NRG also uses interest rate hedging instruments to protect it from an increase in the cost of borrowing. Gains and losses on interest rate

hedging instruments are reported as part of the asset Investments in Unconsolidated Affiliates when the hedging instrument relates to a project that has

financial statements that are not consolidated into NRG’s financial statements. Otherwise, they are reported as a part of debt.

A final derivative instrument used by Xcel Energy is the interest rate swap. The cost or benefit of the interest rate swap agreements is recorded as a

component of interest expense. None of these derivative financial instruments are reflected on Xcel Energy’s balance sheet. For further discussion of

Xcel Energy’s risk management and derivative activities, see Note 13 to the Financial Statements.

Use of Estimates

In recording transactions and balances resulting from business operations, Xcel Energy uses estimates based on the best information available. We use

estimates for such items as plant depreciable lives, tax provisions, uncollectible amounts, environmental costs, unbilled revenues and actuarially determined

benefit costs. We revise the recorded estimates when we get better information or when we can determine actual amounts. Those revisions can affect

operating results. Each year we also review the depreciable lives of certain plant assets and revise them if appropriate.

Cash Equivalents

Xcel Energy considers investments in certain debt instruments – with a remaining maturity of three months or less at the time of purchase – to be cash

equivalents. Those debt instruments are primarily commercial paper and money market funds.

Inventory

All inventory is recorded at average cost, with the exception of natural gas in underground storage at PSCo, which is recorded using last-in-first-out (LIFO) pricing.

XCEL ENERGY INC. AND SUBSIDIARIES

42

XCEL ENERGY INC. AND SUBSIDIARIES