Xcel Energy 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fuel Contracts

Xcel Energy has contracts providing for the purchase and delivery of a significant portion of its current coal, nuclear fuel and natural gas requirements.

These contracts expire in various years between 2001 and 2017. In total, Xcel Energy is committed to the minimum purchase of approximately $2.1 billion

of coal, $13 million of nuclear fuel and $706 million of natural gas and related transportation, or to make payments in lieu thereof, under these contracts. In

addition, Xcel Energy is required to pay additional amounts depending on actual quantities shipped under these agreements. Xcel Energy’s risk of loss, in

the form of increased costs, from market price changes in fuel is mitigated through the cost-of-energy adjustment provision of the ratemaking process,

which provides for recovery of most fuel costs.

Purchase Power Agreements

The utility subsidiaries of Xcel Energy have entered into agreements with utilities and other energy suppliers for purchased power to meet system load and

energy requirements, replace generation from company-owned units under maintenance and during outages, and meet operating reserve obligations. NSP-

Minnesota, PSCo and SPS have various pay-for-performance contracts with expiration dates through the year 2033. In general, these contracts provide for

capacity payments, subject to meeting certain contract obligations, and energy payments based on actual power taken under the contracts. Most of the

capacity and energy costs are recovered through base rates and other cost recovery mechanisms. Additionally, NSP-Minnesota, PSCo and SPS have long-term,

purchased-power contracts with various regional utilities, expiring through 2025.

NSP-Minnesota has a 500-megawatt participation power purchase commitment with Manitoba Hydro, which expires in 2005. The cost of this agreement is based on

80 percent of the costs of owning and operating NSP-Minnesota’s Sherco 3 generating plant, adjusted to 1993 dollars. In addition, NSP-Minnesota and Manitoba

Hydro have seasonal diversity exchange agreements, and there are no capacity payments for the diversity exchanges. These commitments represent about

17 percent of Manitoba Hydro’s system capacity and account for approximately 10 percent of NSP-Minnesota’s 2000 electric system capability. The risk of loss from

nonperformance by Manitoba Hydro is not considered significant, and the risk of loss from market price changes is mitigated through cost-of-energy rate adjustments.

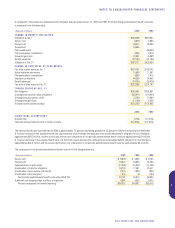

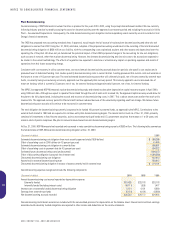

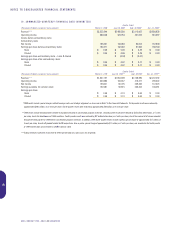

At Dec. 31, 2000, the estimated future payments for capacity that the utility subsidiaries of Xcel Energy are obligated to purchase, subject to availability, are

as follows: Regional

(Thousands of dollars) Other Utilities Total

2001 $ 203,347 $ 253,932 $ 457,279

2002 225,031 241,358 466,389

2003 256,791 231,361 488,152

2004 255,185 221,907 477,092

2005 and thereafter 2,061,785 983,144 3,044,929

Total $3,002,139 $1,931,702 $4,933,841

For the past 37 years, Cheyenne has purchased all energy requirements from PacifiCorp. Cheyenne’s full-requirements power purchase agreement with

PacifiCorp expired in December 2000. During 2000, Cheyenne issued a request for proposal and conducted negotiations with PacifiCorp and other wholesale

power suppliers. During 2000, as contract details for a new agreement were being finalized, supply conditions and market prices in the western United States

dramatically changed. Cheyenne was unable to execute an agreement with PacifiCorp for the prices and terms Cheyenne had been negotiating. Additionally,

PacifiCorp failed to provide the FERC and Cheyenne 60-days notice to terminate service, as required by the Federal Power Act. Cheyenne filed a complaint with

the FERC, requesting that PacifiCorp continue providing service under the existing tariff through the 60-day notice period. On Feb. 7, 2001, the FERC issued an

order requiring PacifiCorp to provide service under the terms of the old contract through Feb. 24, 2001.

Cheyenne has begun implementing the changes required to transition from a full-requirements customer to an operating utility as the best means of providing

energy supply. In February 2001, PSCo filed an agreement with the FERC to provide a portion of Cheyenne’s service. Cheyenne has also entered into agreements

with other producers to meet both short-term and long-term energy supply needs and continues to negotiate with suppliers to meet its load requirements for the

summer of 2001.

Total purchased power costs are projected to increase approximately $80 million in 2001. Purchased power and natural gas costs are recoverable in Wyoming.

Cheyenne is required to file applications with the WPSC for approval of adjustment mechanisms in advance of the proposed effective date and demonstrate

the reasonableness of the costs. Cheyenne expects to make its request for an electric cost adjustment increase in March 2001.

Environmental Contingencies

We are subject to regulations covering air and water quality, the storage of natural gas and the storage and disposal of hazardous or toxic wastes. We

continuously assess our compliance. Regulations, interpretations and enforcement policies can change, which may impact the construction and operation

of, and cost of building and operating, our facilities.

58

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS