Xcel Energy 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

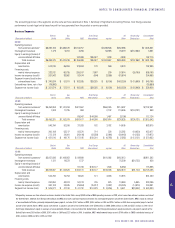

17. CAJUN PRO FORMA RESULTS

During March 2000, NRG completed the acquisition of two fossil-fueled generating plants from Cajun Electric Power Cooperative, Inc., for approximately

$1 billion. The following information summarizes the pro forma results of operations as if the acquisition, which was accounted for as a purchase, had

occurred as of the beginning of the respective periods for which pro forma information is presented. The preacquisition period information is not necessarily

comparable to the postacquisition period information.

Actual Results

(Millions of dollars, except earnings per share) 2000 1999

Revenue $11,592 $7,816

Net income 527 571

Earnings available for common shareholders 523 566

Total earnings per share $ 1.54 $ 1.70

Pro Forma Results

(unaudited)

(Millions of dollars, except earnings per share) 2000 1999

Revenue $11,672 $8,184

Net income 523 574

Earnings available for common shareholders 519 569

Total earnings per share $ 1.54 $ 1.71

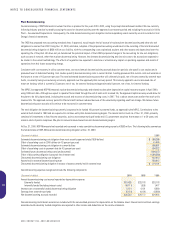

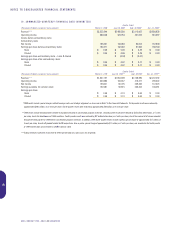

18. SEGMENT AND RELATED INFORMATION

Xcel Energy has five reportable segments: Electric Utility, Gas Utility and three of its nonregulated energy businesses, NRG, Xcel International and e prime,

all subsidiaries of Xcel Energy.

•Xcel Energy’s Electric Utility generates, transmits and distributes electricity in Minnesota, Wisconsin, Michigan, North Dakota, South Dakota,

Colorado, Texas, New Mexico, Wyoming, Kansas and Oklahoma. It also makes sales for resale and provides wholesale transmission service

to various entities in the United States. Electric Utility also includes electric trading.

•Xcel Energy’s Gas Utility transmits, transports, stores and distributes natural gas and propane primarily in portions of Minnesota, Wisconsin,

North Dakota, Michigan, Arizona, Colorado and Wyoming.

•NRG develops, builds, acquires, owns and operates several nonregulated energy-related businesses, including independent power produc-

tion, commercial and industrial heating and cooling, and energy-related refuse-derived fuel production, both domestically and outside the

United States.

•Xcel Energy International’s most significant holding is Yorkshire Power, a joint venture equally owned by Xcel Energy International and a

subsidiary of American Electric Power Co. Yorkshire’s main business is the distribution and supply of electricity and the supply of natural gas

in the United Kingdom.

•e prime trades and markets natural gas throughout the United States.

Revenues from operating segments not included above are below the necessary quantitative thresholds and are therefore included in the All Other category.

Those primarily include a company involved in nonregulated power and natural gas marketing activities throughout the United States; a company that

invests in and develops cogeneration and energy-related projects; a company that is engaged in engineering, design construction management and other

miscellaneous services; a company engaged in energy consulting, energy efficiency management, conservation programs and mass market services; an

affordable housing investment company; a broadband telecommunications company; and several other small companies and businesses.

To report net income for electric and natural gas utility segments, Xcel Energy must assign or allocate all costs and certain other income. In general, costs are:

•Directly assigned wherever applicable;

•Allocated based on cost causation allocators wherever applicable; and

•Allocated based on a general allocator for all other costs not assigned by the above two methods.

64

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS