Xcel Energy 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

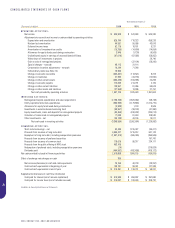

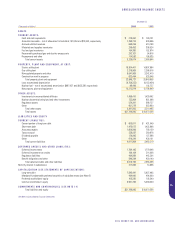

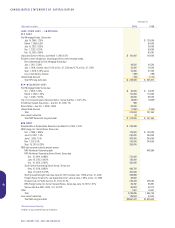

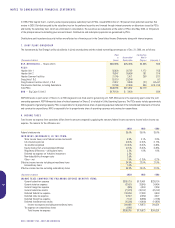

Accumulated

Other Total

Retained Shares Held Comprehensive Stockholders’

(Thousands of dollars) Par Value Premium Earnings by ESOP Income Equity

BALANCE AT DEC. 31, 1997 $802,245 $1,972,223 $2,023,925 $(10,533) $ (58,745) $4,729,115

Net income 624,330 624,330

Unrealized loss from marketable securities,

net of tax of $4,417 (6,416) (6,416)

Currency translation adjustments (16,089) (16,089)

Other comprehensive income for 1998 601,825

Dividends declared:

Cumulative preferred stock of Xcel Energy (5,548) (5,548)

Common stock (475,399) (475,399)

Issuances of common stock – net 23,150 223,985 247,135

Pooling of interests business combinations 6,065 6,065

Tax benefit from stock options exercised 850 850

Loan to ESOP to purchase shares*(15,000) (15,000)

Repayment of ESOP loan*7,030 7,030

BALANCE AT DEC. 31, 1998 $825,395 $2,197,058 $2,173,373 $(18,503) $ (81,250) $5,096,073

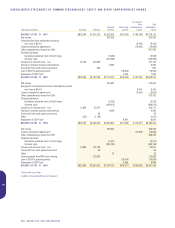

Net income 570,933 570,933

Recognition of unrealized loss from marketable securities,

net of tax of $4,417 6,416 6,416

Currency translation adjustments (3,587) (3,587)

Other comprehensive income for 1999 573,762

Dividends declared:

Cumulative preferred stock of Xcel Energy (5,292) (5,292)

Common stock (489,813) (489,813)

Issuances of common stock – net 12,930 92,247 105,177

Pooling of interests business combinations 4,599 4,599

Tax benefit from stock options exercised 58 58

Other (132) (1,109) (1,241)

Repayment of ESOP loan*6,897 6,897

BALANCE AT DEC. 31, 1999 $838,193 $2,288,254 $2,253,800 $(11,606) $ (78,421) $5,290,220

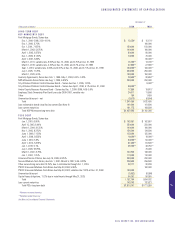

Net income 526,828 526,828

Currency translation adjustments (78,508) (78,508)

Other comprehensive income for 2000 448,320

Dividends declared:

Cumulative preferred stock of Xcel Energy (4,241) (4,241)

Common stock (492,183) (492,183)

Issuances of common stock – net 13,892 102,785 116,677

Tax benefit from stock options exercised 53 53

Other 16 16

Gain recognized from NRG stock offering 215,933 215,933

Loan to ESOP to purchase shares (20,000) (20,000)

Repayment of ESOP loan*6,989 6,989

BALANCE AT DEC. 31, 2000 $852,085 $2,607,025 $2,284,220 $(24,617) $(156,929) $5,561,784

*Did not affect cash flows

See Notes to Consolidated Financial Statements

36

XCEL ENERGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMMON STOCKHOLDERS’ EQUITY AND OTHER COMPREHENSIVE INCOME