Xcel Energy 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

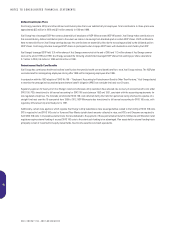

to complete these divestitures by January 2006. In May 2000, the PUCT issued an order approving the stipulation. SPS has committed to transfer functional

control of its electric transmission system to a regional transmission organization that will operate the transmission systems of multiple owners in the

central United States.

SPS filed a rate case in March 2000 to set the rates for distribution services in Texas, which are to be unbundled and implemented in January 2002. SPS

requested recovery of all jurisdictional costs associated with restructuring in Texas. Hearings and a final rate order are not expected before August 2001.

In June 2000, SPS filed its transition plan with the NMPRC. SPS filed to establish rates for the transmission and distribution business in New Mexico,

requesting approval of its corporate restructuring/separation and other associated matters. Hearings were held in October and November 2000. Final

approval is not expected until mid-2001.

Financial Impact With the issuance of a final written order by the PUCT in May 2000, addressing the implementation of electric utility restructuring,

SPS discontinued regulatory accounting under SFAS71 for the generation portion of its business during the second quarter of 2000. Consistent with

current accounting rules, this resulted in extraordinary charges in the second and third quarters of 2000. During the second quarter of 2000, SPS wrote

off its generation-related regulatory assets and liabilities, totaling approximately $19.3 million before taxes. This resulted in an after-tax extraordinary

charge of approximately $13.7 million against the earnings of Xcel Energy and SPS. During the third quarter of 2000, SPS recorded an extraordinary charge of

$8.2 million before tax, or $5.3 million after tax, related to the tender offer and defeasance of approximately $295 million of first mortgage bonds. The first

mortgage bonds were defeased to facilitate SPS’ eventual divesture of generation assets.

SPS transmission and distribution business continues to meet the requirements of SFAS71, as that business is expected to remain regulated.

Additionally, there may be other significant financial implications of implementing SB-7 and electric restructuring in New Mexico. These implications

include, but are not limited to, investments in information technology, establishing an independent operation of the electric transmission systems,

implementing the procedures to govern affiliate transactions, the pricing of unbundled energy services and the regulatory recovery of incurred costs

related to these issues. These costs could be as much as $75 million. The total impacts of restructuring are unknown at this time and may have a

significant financial impact on the financial position, results of operations and cash flows of Xcel Energy and SPS.

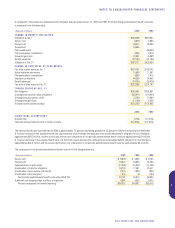

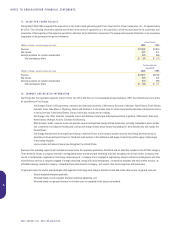

13. FINANCIAL INSTRUMENTS

Fair Values

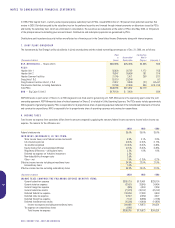

The estimated Dec. 31 fair values of Xcel Energy’s recorded financial instruments are as follows:

2000 1999

Carrying Fair Carrying Fair

(Thousands of dollars) Amount Value Amount Value

Mandatorily redeemable preferred securities $ 494,000 $ 481,270 $ 494,000 $ 427,240

Long-term investments $ 625,616 $ 624,989 $ 543,300 $ 538,926

Long-term debt, including current portion $8,187,052 $8,131,139 $6,258,534 $5,997,522

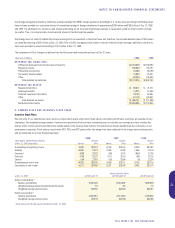

For cash, cash equivalents and short-term investments, the carrying amount approximates fair value because of the short maturity of those instruments. The

fair values of Xcel Energy’s long-term investments, mainly debt securities in an external nuclear decommissioning fund, are estimated based on quoted market

prices for those or similar investments. The fair value of Xcel Energy’s long-term debt and the mandatorily redeemable preferred securities are estimated based

on the quoted market prices for the same or similar issues, or the current rates for debt of the same remaining maturities and credit quality.

The fair-value estimates presented are based on information available to management as of Dec. 31, 2000 and 1999. These fair-value estimates have not

been comprehensively revalued for purposes of these financial statements since that date, and current estimates of fair values may differ significantly from

the amounts presented herein.

Guarantees

Xcel Energy has entered into a construction contract guarantee that assures Quixx’s performance under its engineering, procurement and construction contract

with Borger Energy Associates, LP (BEA). Quixx, which owns 45 percent of BEA, is constructing a 230-megawatt cogeneration facility at a Phillips Petroleum

site near Borger, Texas. The maximum aggregate amount of this guarantee at Dec. 31, 2000, was $88.4 million. This maximum amount decreases to $25 million

at commercial operation of the facility and remains in effect for a period of no longer than 24 months before expiring.

In July 1999, Xcel Energy entered into a guarantee resulting from non-completion of certain milestone achievements within required dates in connection with

the Quixx Linden cogeneration plant. The guarantee, totaling approximately $7.5 million, is for the benefit of Bank One and all other lenders in Quixx Linden, LP.

Once the milestone events are accomplished, the guarantee is required to remain for six months.

As of Dec. 31, 2000, Xcel Energy had outstanding approximately $190 million of guarantees relating to e prime. These guarantees were made to facilitate

e prime’s natural gas marketing and trading activities.

54

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS