Xcel Energy 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

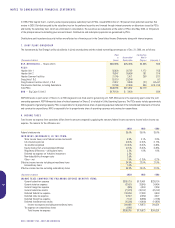

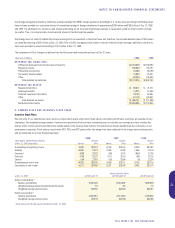

A comparison of the actuarially computed pension benefit obligation and plan assets at Dec. 31, 2000 and 1999, for all Xcel Energy plans on a combined

basis is presented in the following table.

(Thousands of dollars) 2000 1999

CHANGE IN BENEFIT OBLIGATION

Obligation at Jan. 1 $2,170,627 $2,157,255

Service cost 59,066 63,674

Interest cost 172,063 154,619

Acquisitions 52,800

Plan amendments 2,649 184,255

Actuarial (gain) loss 1,327 (225,355)

Benefit payments (204,394) (163,821)

Obligation at Dec. 31 $2,254,138 $2,170,627

CHANGE IN FAIR VALUE OF PLAN ASSETS

Fair value of plan assets at Jan. 1 $3,763,293 $3,460,740

Actual return on plan assets 91,846 466,374

Acquisitions 38,412

Benefit payments (204,394) (163,821)

Fair value of plan assets at Dec. 31 $3,689,157 $3,763,293

FUNDED STATUS AT DEC. 31

Net asset $1,435,019 $1,592,666

Unrecognized transition (asset) obligation (16,631) (23,945)

Unrecognized prior-service cost 228,436 247,632

Unrecognized (gain) loss (1,421,690) (1,680,616)

Prepaid pension asset recorded $ 225,134 $ 135,737

2000 1999

SIGNIFICANT ASSUMPTIONS

Discount rate 7.75% 7.5–8.0%

Expected long-term increase in compensation level 4.50% 4.0–4.5%

Expected average long-term rate of return on assets 8.5–10.0% 8.5–10.0%

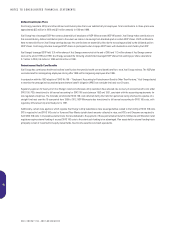

The components of net periodic pension cost (credit) for Xcel Energy plans are:

(Thousands of dollars) 2000 1999 1998

Service cost $ 59,066 $ 63,674 $ 55,545

Interest cost 172,063 154,619 145,574

Expected return on plan assets (292,580) (259,074) (233,191)

Amortization of transition asset (7,314) (7,314) (7,314)

Amortization of prior-service cost 19,197 17,855 6,209

Amortization of net gain (60,676) (40,217) (30,607)

Net periodic pension cost (credit) under SFAS 87 $(110,244) $ (70,457) $ (63,784)

Credits not recognized due to effects of regulation 49,697 36,469 35,545

Net benefit cost (credit) recognized for financial reporting $ (60,547) $ (33,988) $ (28,239)

Additionally, Xcel Energy maintains noncontributory, defined benefit supplemental retirement income plans for certain qualifying executive personnel.

Benefits for these unfunded plans are paid out of Xcel Energy’s operating cash flows.

XCEL ENERGY INC. AND SUBSIDIARIES

49

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS